Online and mobile shopping is on the rise worldwide, and with it come multiple advancements in the way online shoppers pay for their Internet purchases. In 2015, the competition in the global online payment market has attracted a wide range of players, from the traditional ones such as banks, payment processors and card companies, to telecommunication operators, tech companies and merchants.

In this context, North America emerges as a major playground for the rollout of new online and mobile payment solutions, while the innovations quickly gather speed and popularity. Among the examples are the newly developed express checkout services allowing online shoppers a one-click checkout that can be employed for payments to multiple merchants. Visa Checkout was launched in the USA, Canada and Australia in 2014 and continues to expand, followed by PayPal’s OneTouch, launched in the USA in April 2015. American Express’ Amex Express Checkout was also made available to merchants in early 2015.

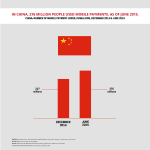

The fast growing mobile payment market, heated up by Apple Pay’s US launch in 2014, is now facing intensified competition too, with Google’s mobile payment app Android Pay launching in the US in late 2015, and Samsung Pay also becoming available to US customers after its trial in South Korea. The effort to attract mobile payment users can be expected to pay off and increase the level of payment user penetration, which as of 2014 was just below one-third of shoppers, and left the US ranking behind other regions such as Asia-Pacific and Latin America.

Another significant trend in mobile payments in North America peer-to-peer money transfers – also attracted increasing competition in 2015, with both Google and Facebook making moves in the market. In late 2015, the tech giant reformatted its Google Wallet into a peer-to-peer payment app, while Facebook introduced peer-to-peer transfer as a possibility for Facebook Messenger users. A clear leader in this intense environment is yet to emerge, but with mobile payment usage forecasted to continue increasing, competition will most certainly remain dynamic.

More information on these and other mobile and online payment trends in North America is available in our report “North America Online Payment Methods: Full Year 2015”.