“Europe Online Payment Methods: Second Half 2015” is the title of the new report by Germany-based secondary market research specialist yStats.com. The report reveals the varying payment method preferences of online shoppers across Europe and highlights new market developments. As yStats.com’s CEO and Founder, Yücel Yelken, points out, “While credit card is a major online payment method across the globe, in Europe its dominance is challenged by alternative payment methods, both in emerging and advanced B2C E-Commerce markets”.

Online payment methods continue to evolve as B2C E-Commerce markets grow across Europe. One of the findings of the report by yStats.com is that alternative payment methods rank high in online shoppers’ preferences in these regions. Though in countries such as the UK and France, around half of online shoppers chose to use credit card to pay for purchases online in 2015, both among advanced and emerging European markets there are countries where credit cards rank below alternative payment methods.

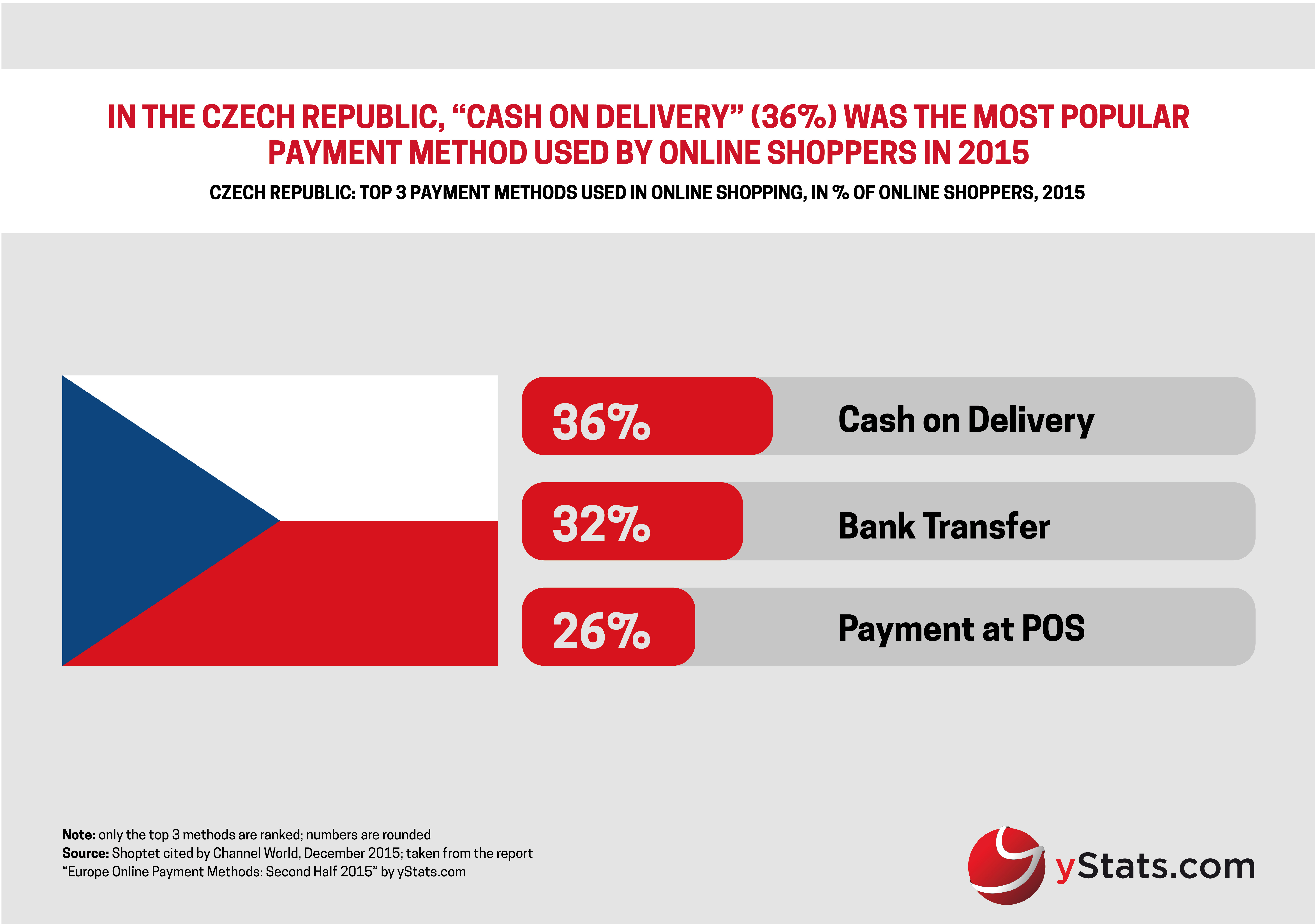

This trend is especially evident in Eastern Europe, as yStats.com’s report shows. In Russia, cash on delivery still holds strong positions, but non-cash payment methods have gained in share of online shoppers, while cash on delivery was losing percentage points over the past years. Also in the Czech Republic and Romania cash on delivery was the payment method most used by online shoppers last year. However, in Poland, bank transfer ranked higher, while in Turkey and Greece credit card accounted for the majority of online transactions.

Among the advanced markets of Western Europe, there are also exceptions to the dominance of credit cards in online payments, according to yStats.com’s findings. In Germany, for example, invoice was preferred by more than three quarters of online shoppers, closely followed by PayPal, and in the Netherlands, local banking method iDEAL remains in the lead, accounting for more than half of online purchases made in the first half of 2015.

Online retailers, payment providers and banks strive to satisfy online shoppers’ preferences and offer the most convenient and secure methods, yStats.com’s report reveals. For example, Amazon launched the Amazon Pay Monthly scheme in the UK, while in Germany multiple banks and other financial institutions cooperated for the launch of the new Paydirect method. More launches are expected to come as competition intensifies in the growing online payment landscape in Europe.