A new publication by secondary market research company yStats.com, based in Germany, reveals that shoppers in Asia-Pacific are among global leaders in usage of digital payment methods. The report “Asia-Pacific Online Payment Methods: First Half 2016” also highlights the differences in payment method preferences of online shoppers across various countries of the region and sheds light on market trends and competition.

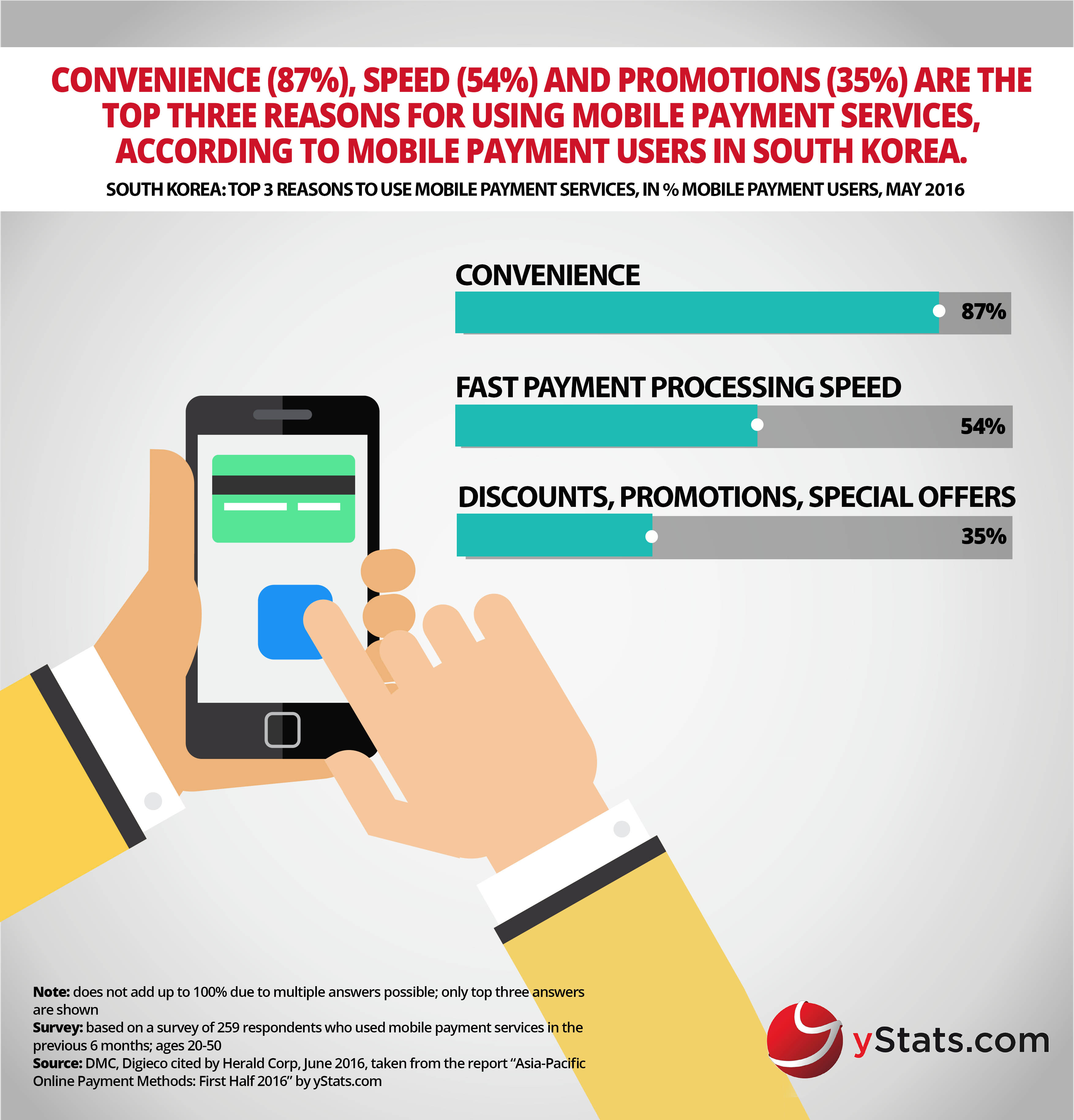

Though strong discrepancies exist between the payment methods preferred by online shoppers in advanced and emerging markets of Asia-Pacific, there is one common characteristic that sets this region apart from the rest of the world, as the report by yStats.com finds. Driven by convenience, consumers in South Korea, China, Australia and other markets are adopting innovative digital payment methods and use them both in-store and online.

Driven by tech-savvy consumers, innovative payment companies are bourgeoning in Asia-Pacific. Digital wallet user penetration across the region doubled in two years to 2015. In South Korea, N Pay and Kakao Pay surpassed the 10 million user mark in H1 2016. Surveys cited in the yStats.com report showed that close to a quarter of online shoppers in South Korea use mobile payments to make purchases online because it is fast and convenient and in Australia a double-digit share of shoppers favors saving their payment details for one-click ordering.

China set a record in penetration of digital payment service users among online shoppers in 2015 and also has the world’s largest number of mobile payers in-store. Alipay and Wechat Pay count hundreds of millions of users in China. In other emerging markets, such as India and Vietnam, cash on delivery is still the dominant online payment method, so the potential of innovative digital payments awaits further development there.