A new report by Germany-based secondary market research company yStats.com, titled “Asia-Pacific Cross-Border B2C E-Commerce 2015” highlights the cross-border potential of the fast growing online retail market in the Asia-Pacific region. yStats.com’s CEO and founder, Yücel Yelken, mentions that “Asia-Pacific could grow its share of global cross-border B2C E-Commerce sales to nearly one-half within the next five years”.

Asia-Pacific is the largest region in the world in online retail sales and continues to grow rapidly. Cross-border online shopping is an important trend in this region, which is reported to have the potential to account for nearly half of all cross-border B2C E-Commerce sales worldwide in 2020. Cross-border online shopper penetration throughout the region varied from a low one-digit percentage in Indonesia to a high of over two-thirds in Australia, as of the beginning of 2015.

China is the key destination of both cross-border online imports and exports. Close to a third of active online shoppers made purchases across borders in China last year, while China itself ranked at least in the top 3 online shopping destinations of consumers in countries such as Russia, Brazil, and many others. China’s major E-Commerce companies, Alibaba and JD.com, compete on both fields, using their marketplaces to enable foreign merchants to access Chinese online consumers and China-based merchants to access overseas online shoppers.

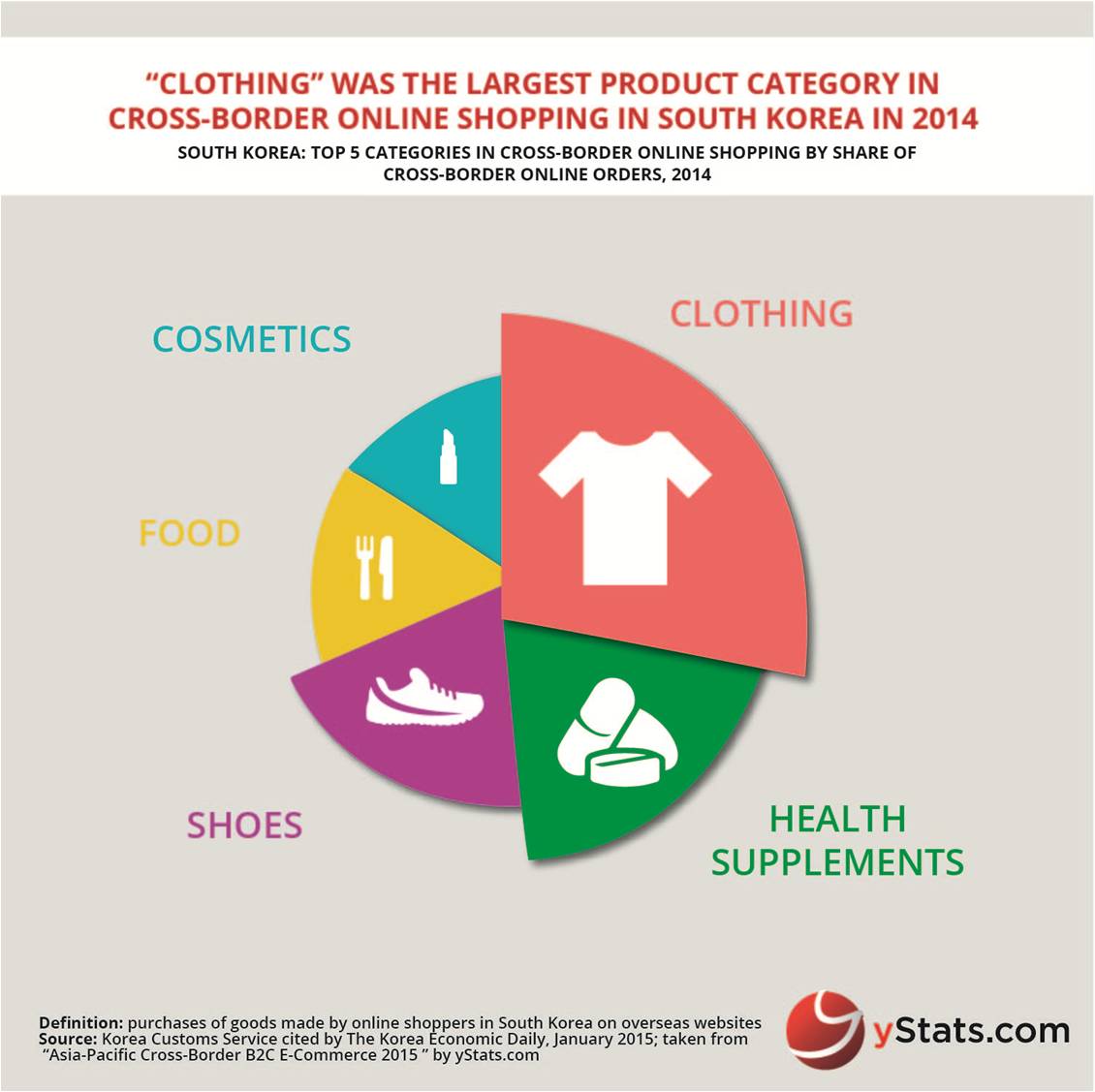

Another major B2C E-Commerce market, Japan, has intense cross-border online trade with China and the USA, with cross-border B2C E-Commerce exports to these countries from Japan outweighing imports in 2014. In South Korea, as well, the USA and China were the top two destinations for cross-border online shoppers last year, while the most purchased product categories were clothing and health supplements. The emerging Southeast Asian markets also participate in the cross-border trend, led by Singapore.