The new report from yStats.com, an international secondary market research firm headquartered in Germany, reveals innovations in digital payments in the USA and Canada. The publication, titled “North America Online Payment Methods: Full Year 2016” brings together multiple market statistics, surveys and forecasts released last year. Among the key findings of the report is the dominance of card payments for online and mobile purchases in both countries covered.

According to this report from yStats.com, credit card networks, such as Visa, MasterCard and American Express dominate E-Commerce payments in the USA and Canada. Surveys cited in the report reveal that credit card is not only the most used, but also the most trusted method for making online payments. In Canada, credit cards contribute a major double-digit share to E-Commerce transaction value, by far outpacing online debits and E-Wallets. On the regional level, over two-thirds of online consumers prefer credit cards to other payment methods when buying digitally.

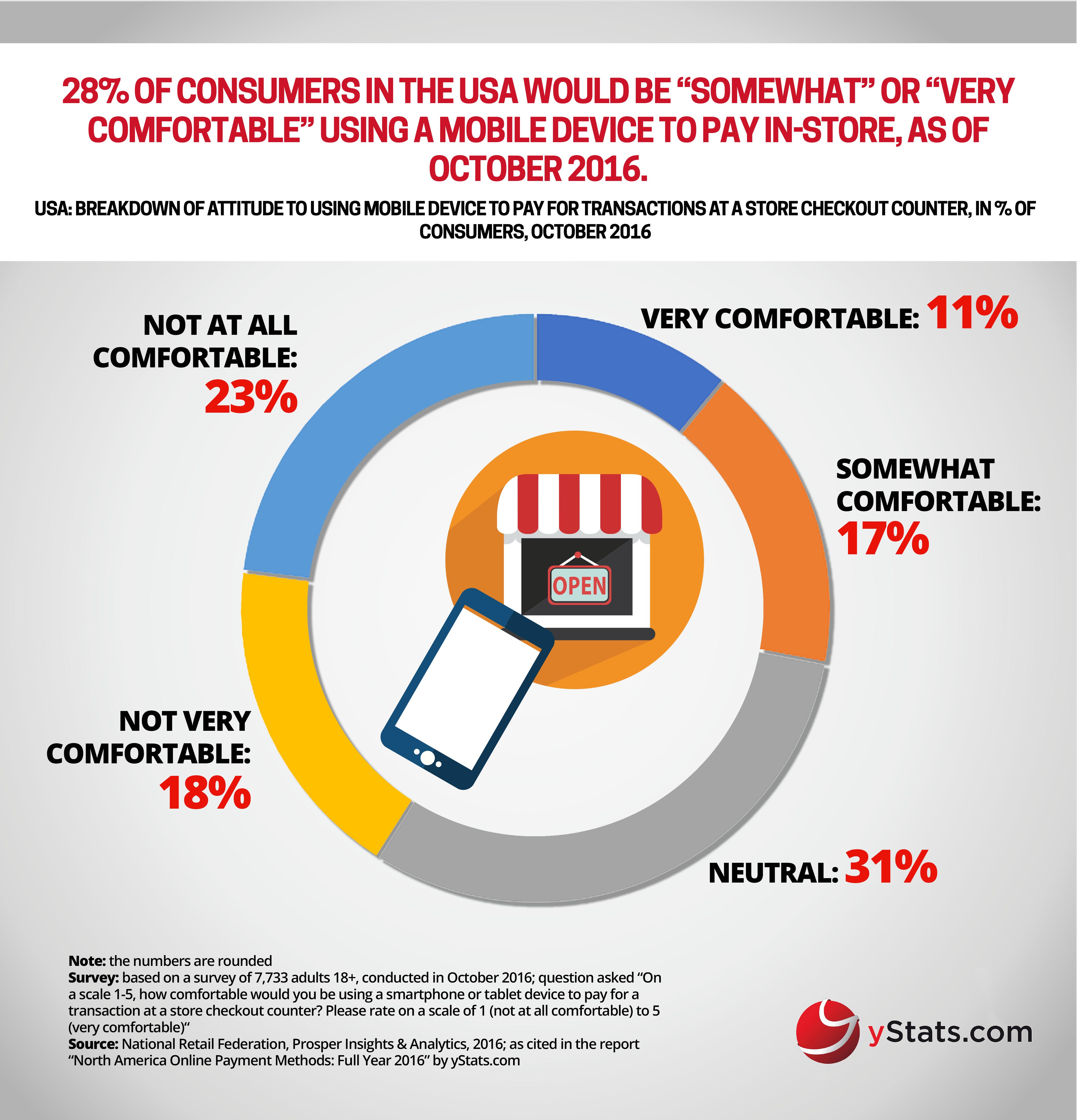

Another major finding of yStats.com’s publication concerns the growth of mobile payments across the North America region. Although only a small one-digit share of retail payments in the USA and Canada is done via mobile devices, consumers have indicated that they expect to pay for a larger portion of their purchases through mobile in the near future. Mobile wallets by major card networks are projected to gain the most and nearly equal PayPal in frequency of making mobile payments in 2020. Nevertheless, for mobile payment to live up to its potential, retailers and payment providers need to convince consumers of the safety of this payment method. yStats.com cites reports showing that around a quarter of U.S. consumers are comfortable with paying via mobile in-store and more than 50% of Internet users in Canada would be more likely to pay via mobile if they knew it was secure.

Payment security is a major consideration not only for mobile, but also for other digital payment channels. According to a recent U.S. household survey cited by yStats.com, nearly one-half of respondents were wary of credit card or banking fraud when transacting online. With online payment fraud on the rise worldwide, merchants and payment companies are creating innovative payer authentication solutions, of which fingerprint ID has found the widest acceptance among U.S. online shoppers.