Leading Germany-based secondary market research provider yStats.com dives into the latest developments and projections for the world’s largest online retail nation in their new report “China B2C E-Commerce Market 2018.” The publication reveals that China accounted for nearly 50% of global digital commerce in 2017, with a projection to increase its share by 2021. Amidst continuing sales growth, increasing mobile penetration, O2O and social commerce trends plus the use of latest technologies by the top market players, China’s “New Retail” is advancing.

China is the world’s leader by combined B2C and C2C E-Commerce revenues, generating almost one-half of global online sales of products and services in 2017. Due to ongoing strong growth, China will add several more percentage points to its share by 2021, according to a forecast cited in the yStats.com report. While an increasing share of overall retail is done online, China’s E-Commerce market leaders expand into the offline space with innovative technologies and seamless logistics, bringing about the omnichannel commerce. Other emerging market trends include social commerce via platforms such as WeChat, cross-border shopping, and the rapid growth of online-to-offline (O2O) services like food delivery.

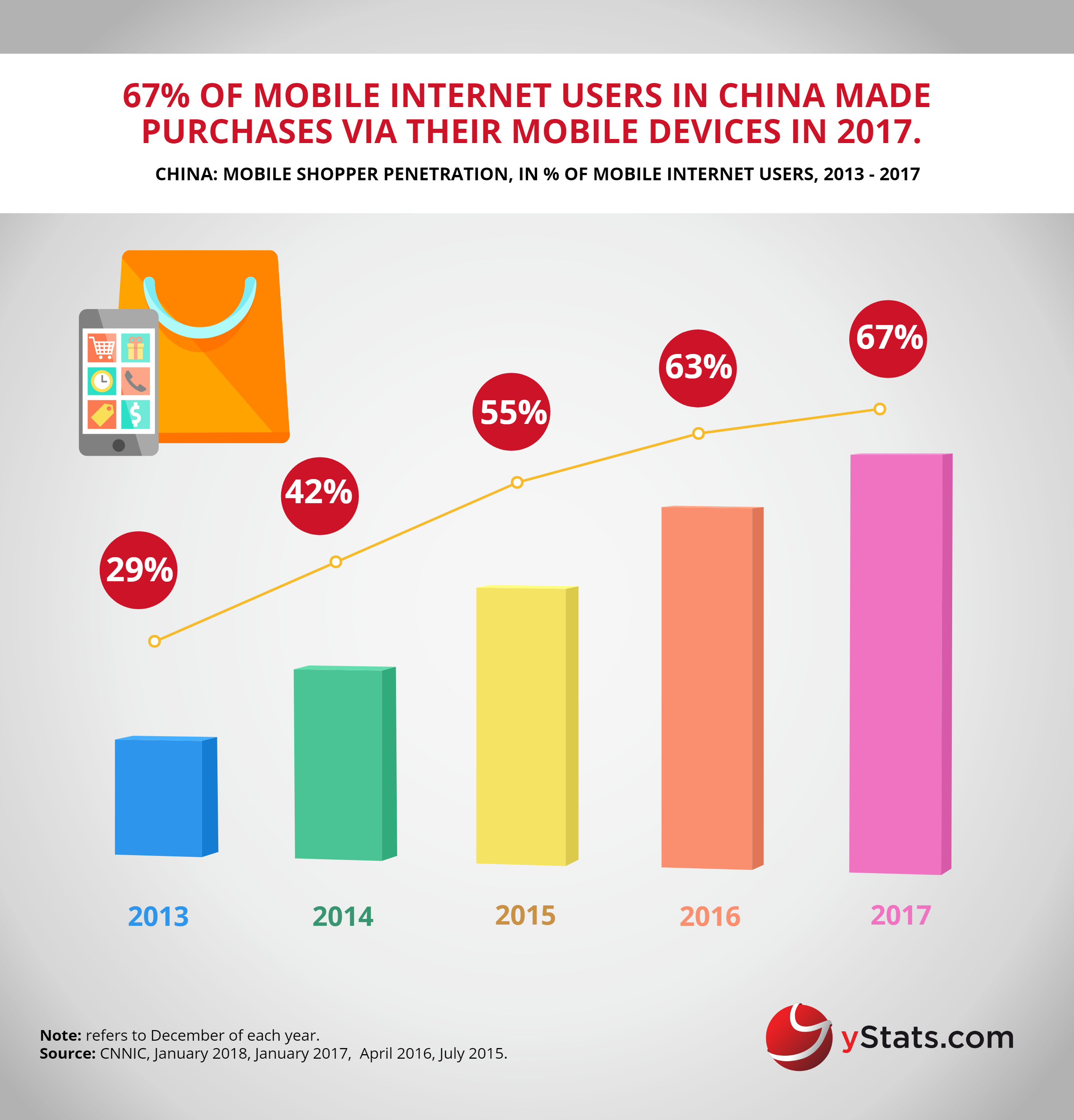

The yStats.com report also reveals the preferences of the half a billion consumers shopping online in China. Mobile is the main device used by China’s digital consumers to make purchases, with M-Commerce accounting for more than three-quarters of overall online shopping GMV from 2016 on. Apparel is the most popular E-Commerce product category, with online retailers preferred over brick-and-mortar stores to purchase clothes and accessories. Furthermore, third-party payment services like as Alipay and WeChat are the top payment methods used by an overwhelming majority of online shoppers in China.

Tmall.com of the Alibaba Group stands as the largest B2C E-Commerce market player in China, with a market share of more than 50%, according to sources cited in the yStats.com publication. Under its “New Retail” strategy, Alibaba launched a number of brick-and-mortar locations for Tmall, including unmanned stores for apparel and books which use facial recognition and mobile payment technologies. Alibaba’s rival JD.com also advances in the omnichannel space with its offline fresh food and home appliances stores. Both companies are seeing rapid growth in online sales domestically and expand abroad.