Leading Germany-based secondary market research provider yStats.com delves into the latest developments and projections for the world’s largest online retail nation in its new report “China B2C E-Commerce Market 2019”. The publication reveals that China is currently projected to account for more than 50% of global digital commerce, with a forecast to increase its share by 2022. Among the key findings of the report is that mobile device use and cross-border and social commerce purchases are increasing, plus that online and offline shopping integration is growing. The report also discusses the fierce competition on the retail E-Commerce market scene in China.

China is to remain the world’s largest online retail market and experience further growth of online and offline integration

China is the world’s largest online retail market, currently generating more than one-half of global retail E-Commerce sales of products and services. The country’s E-Commerce market is still expanding and projected to add several more percentage points to its share of worldwide sales by 2022, according to a forecast cited in the yStats.com report. Local sources project online retail sales in China for different periods, reaching as far as 2023, to grow at a strong double-digit growth rate. Even though an increasing proportion of total sales is performed online, the online and offline integration, also called “new retail”, is projected to experience further development.

Mobile shopping, social and cross-border commerce drive the online retail market in China

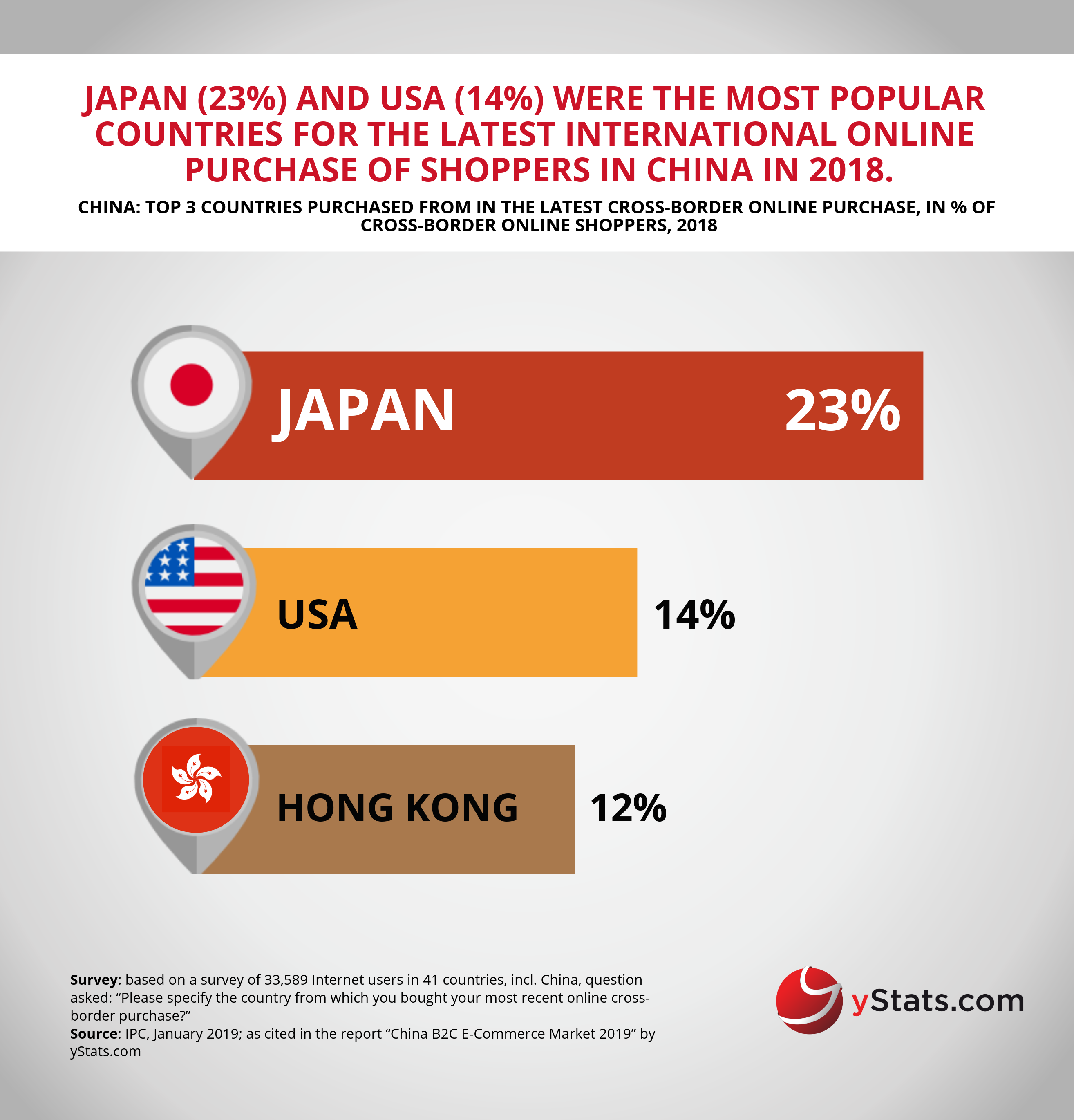

Mobile is the main device used in China not only to connect to the Internet, but also to make digital purchases. Thus, it is no surprise that the country also leads at worldwide M-Commerce, with a share of close to 80%, according to a source cited in the yStats.com report. Another important trend is social commerce, with its gross merchandise value forecasted to more than double between 2019 and 2021. Furthermore, Chinese online shoppers are increasingly purchasing from foreign sellers, with cross-border retail E-Commerce sales to the country experiencing continuous growth.

Alibaba and JD.com hold a duopoly of Chinese retail E-Commerce market

Alibaba is the largest B2C E-Commerce market player in China, with a current market share of more than 55%, followed by JD.com, according to a source cited in the yStats.com publication. Both companies are further expanding into omnichannel, with Alibaba investing in China’s major furniture retailer and JD.com in a home appliances company and opening its first unmanned convenience store. Furthermore, social commerce is becoming more and more noticed by E-Commerce market leaders in China. According to a source cited in the yStats.com report, JD.com reached out to various local social commerce platforms to seek possible collaboration.