“Europe Online Payment Methods: Second Half 2017” is a new publication from the regular series of reports about global online and mobile payments from Germany-based secondary market research specialist yStats.com. The report sheds light on the payment preferences of online shoppers in 20 different countries of Europe and highlights the main trends in the region and worldwide. One of the report’s findings is that payment security remains a major concern of online consumers in Europe.

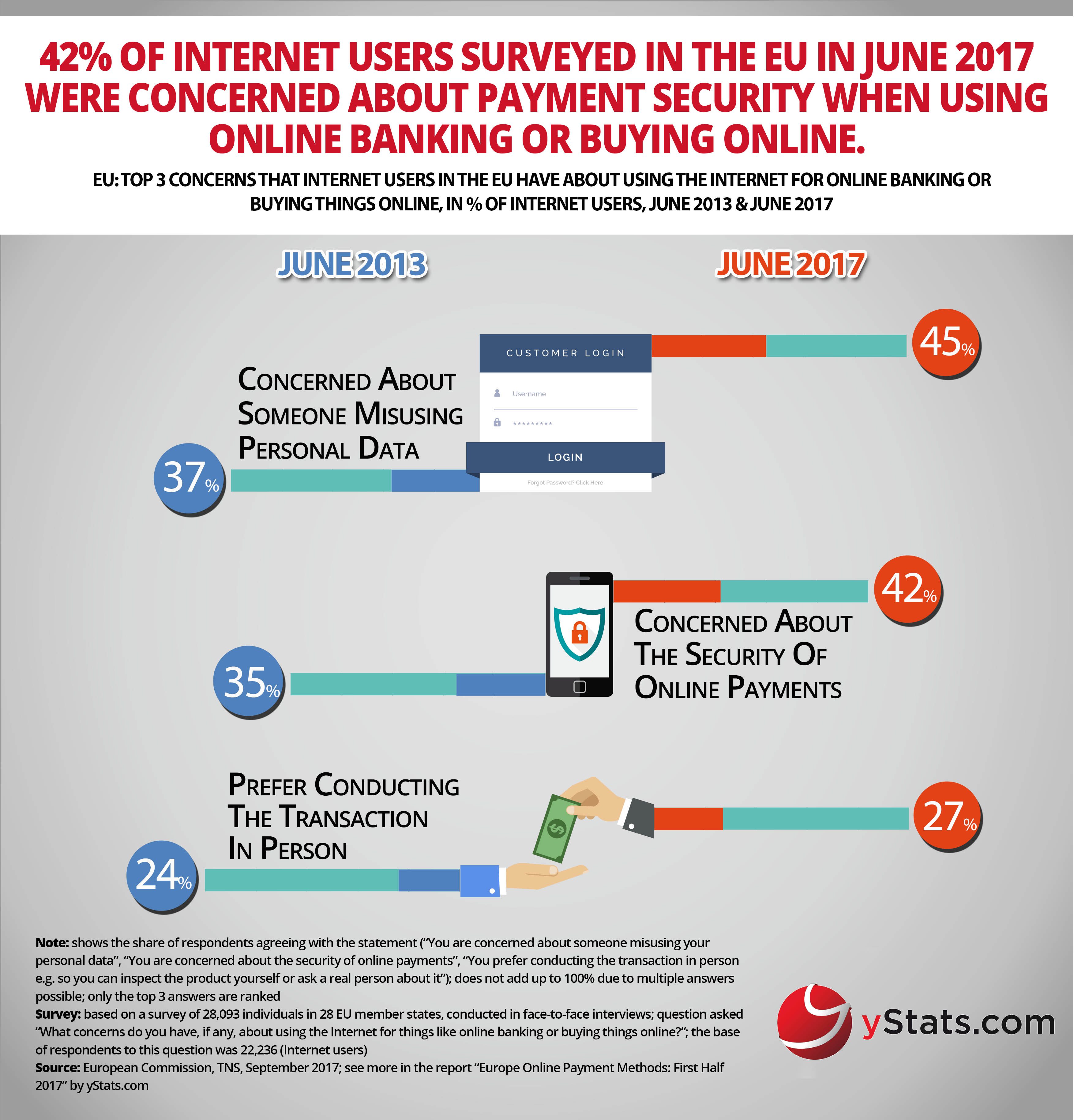

The online payment methods landscape in Europe remains dynamic, as B2C E-Commerce sales continue to grow across the region and new payment regulations are adopted. The revised Payment Services Directive (PSD2) becomes applicable in the EU from January 2018, with some of the major consequences expected to be increased competition in European payments, the emergence of innovative payment solutions and better security for consumers. Safety of the payment process in online and mobile shopping remains a major concern for digital buyers in Europe. According to a recent survey cited in the yStats.com’s publication, the share of Internet users in the EU who were concerned about security of payment online increased by several percentage points over the past four years and was the highest in countries such as Ireland, Luxembourg and Spain.

The security of payment information also influences the choice of payment methods when consumers in Europe make purchases online. In Spain, for example, close to two-thirds of online shoppers named security as the top criterion for choosing a method to pay online. Digital wallets such as PayPal were the most popular way to pay for digital purchases in Spain, as they were in multiple other countries including Germany, Ireland, Italy, and others. Overall, on regional average, digital wallets ranked ahead of international credit cards such as Visa or Mastercard in terms of online shoppers’ preference, according to results of a survey conducted in 2017 and cited in the yStats.com’s report. In Eastern European countries, such as Czech Republic, Hungary, Romania and Russia, cash on delivery was still one of the most popular payment methods as of 2017.

Mobile payment methods also continue to evolve across the region. In Denmark, for example, MobilePay has become the second most popular payment method used by online shoppers, while online shoppers in Sweden ranked mobile payment solution Swish as the easiest and fastest way to pay online, according to research cited by yStats.com. The two Scandinavian countries, along with Norway and the UK are also expected to have the highest share of smartphone users making mobile payments in-store in 2018.