A new report from the Germany-based secondary market research organization yStats.com, “Global B2B Payment Trends 2018” highlights the latest developments in corporate payments. The report cites growth projections for B2B payment volume worldwide and concludes that the market is undergoing a technology-led transformation, increasingly becoming digitalized.

B2B is the biggest market opportunity in global payments

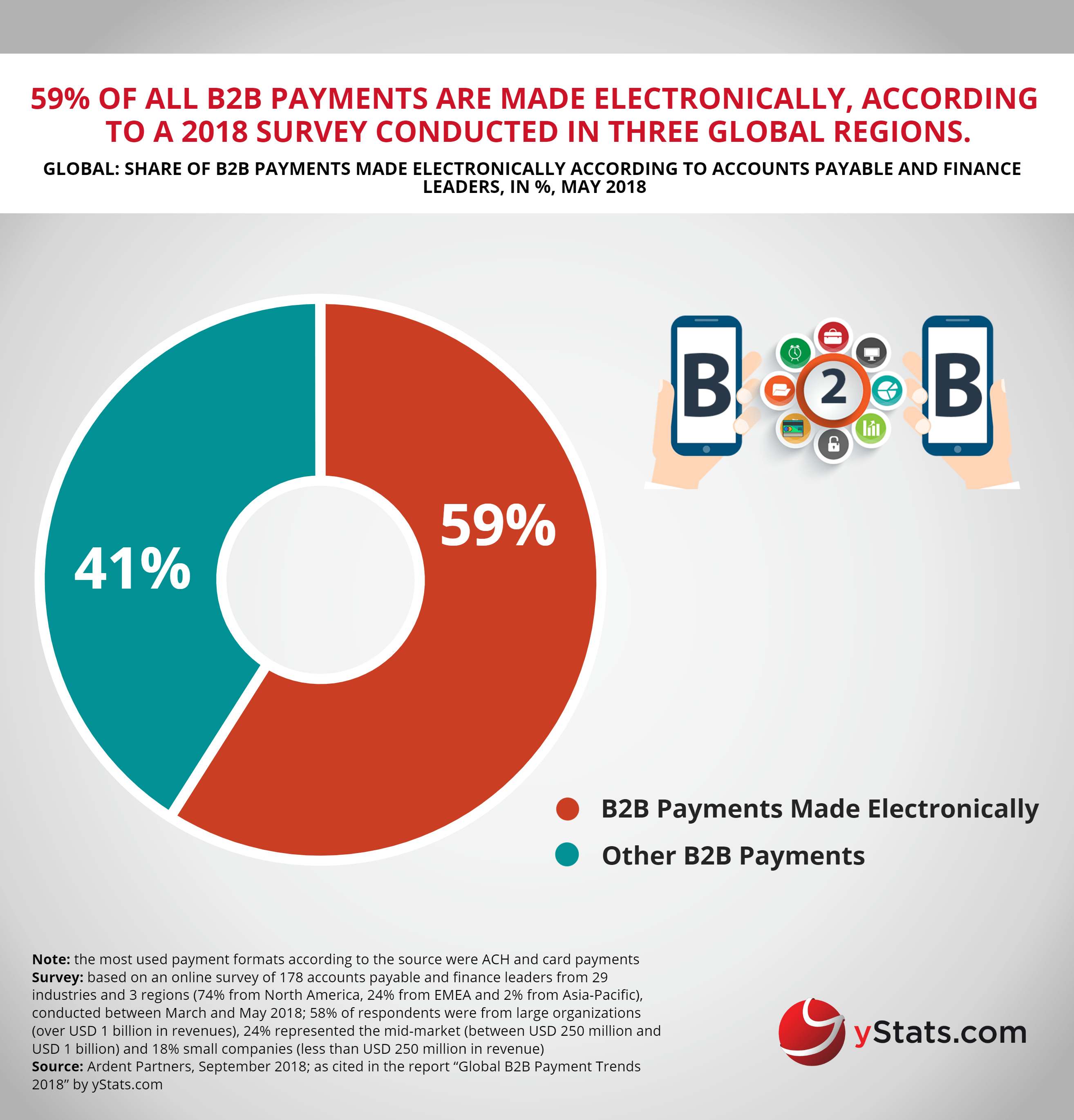

B2B payment is the largest segment of the global payments market. Trillions of U.S. dollars are transacted between businesses annually, with robust growth expected for the next ten years. Driven by the expansion of the technology-powered B2B payment offerings of the leading FinTech companies, card networks and software solution providers, and the adoption of E-Commerce by businesses, corporate payments are becoming increasingly digitalized. According to a 2018 survey cited in the yStats.com report, one-half of global B2B payments are already made electronically with further shift towards digital transfers expected in the next two to five years.

FinTech facilitates the digital transformation of B2B payments

New technologies such as big data analytics, artificial intelligence, machine learning, and instant payments are expected to help businesses reduce inefficiencies in the complex B2B payments processes and tackle the problem of payment delays. The share of past due B2B payments ranges by region from one-third to more than one-half of all B2B receivables, according to the latest data cited in the yStats.com report. Furthermore, FinTech is disrupting the cross-border B2B payments space, with their share of transaction value projected to increase through 2022.

Mobile B2B payment methods on the rise

The growth of global B2B E-Commerce, projected to become more than double the size of the B2C online market over the next two years, is another disruptor of the B2B payments space. While traditional card payments lead the current B2B E-Commerce payment offerings, more businesses start to offer mobile payment options to their clients. Data from 2018 cited in the yStats.com report indicates the growing comfort of treasurers in using mobile payment applications.