The use of online and mobile payment services continues to rise in Asia-Pacific, according to the findings featured in a newly released report by yStats.com. The publication, “Asia-Pacific Online Payment Methods 2019”, reveals the payment preferences of digital buyers across the region’s top markets and points to the growth potential of mobile wallets.

Mobile payments rise in Asia-Pacific

The nations of the Asia-Pacific region are the global leaders in mobile payments. More than one in two smartphone users are expected to pay using a mobile device in 2019, high above the worldwide average, reports yStats.com. In China alone, more than half a billion people use mobile payment services such as Alipay and WeChat Pay to transact in online and brick-and-mortar stores. Even in cash-dominated societies such as India, mobile wallets help to drive the growth of digital payments and reduce the share of cash transactions.

Alternative payment methods dominate in E-Commerce

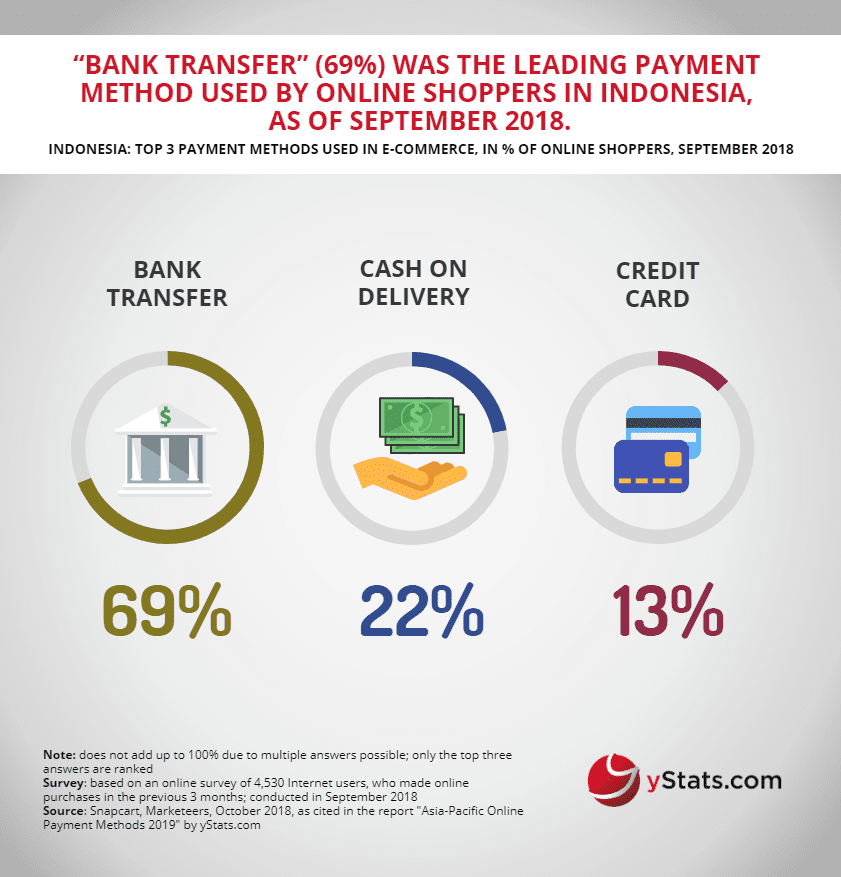

Due to the growing popularity of digital wallet services, more than 50% of E-Commerce transaction value in Asia-Pacific is attributed to alternative payment methods, according to the data cited in the yStats.com report. Nevertheless, in countries including Japan and South Korea, plastic is still king, with a high usage rate among online shoppers. Other popular online payment methods include bank transfer, which is popular in Indonesia and Thailand among others.

Competition in digital payments intensifies across Asia-Pacific

Amidst digital payment growth, competition among key market players remains intense, heated by an inflow of investment into Asian FinTechs. Despite rivalry from third-party providers, traditional banks and other financial corporations also partake in this digital payments boom, including in Japan and Australia where these institutions have rolled out their own tap & pay and other mobile wallet solutions.