A new report published by Germany-based E-Commerce research specialist yStats.com, “GCC B2C E-Commerce Market 2018,” compiles market data, trends and projections regarding the growth of online retail in the Gulf. The report concludes that B2C E-Commerce has not yet reached its full potential in these six markets and is forecast to more than double in size between 2017 and 2020.

B2C E-Commerce in the six member nations of The Cooperation Council for the Arab States of the Gulf (GCC) is in early stages of development. Even in the UAE, the largest online retail market of the pack, E-Commerce accounts for a small one-digit percentage share of total retail sales. Starting off from this low base, online retail in the GCC is projected to see robust growth rates over the next several years. By 2020, retail E-Commerce sales of the GCC countries are projected to be more than two times higher than in 2017, according to a projection cited in the yStats.com report.

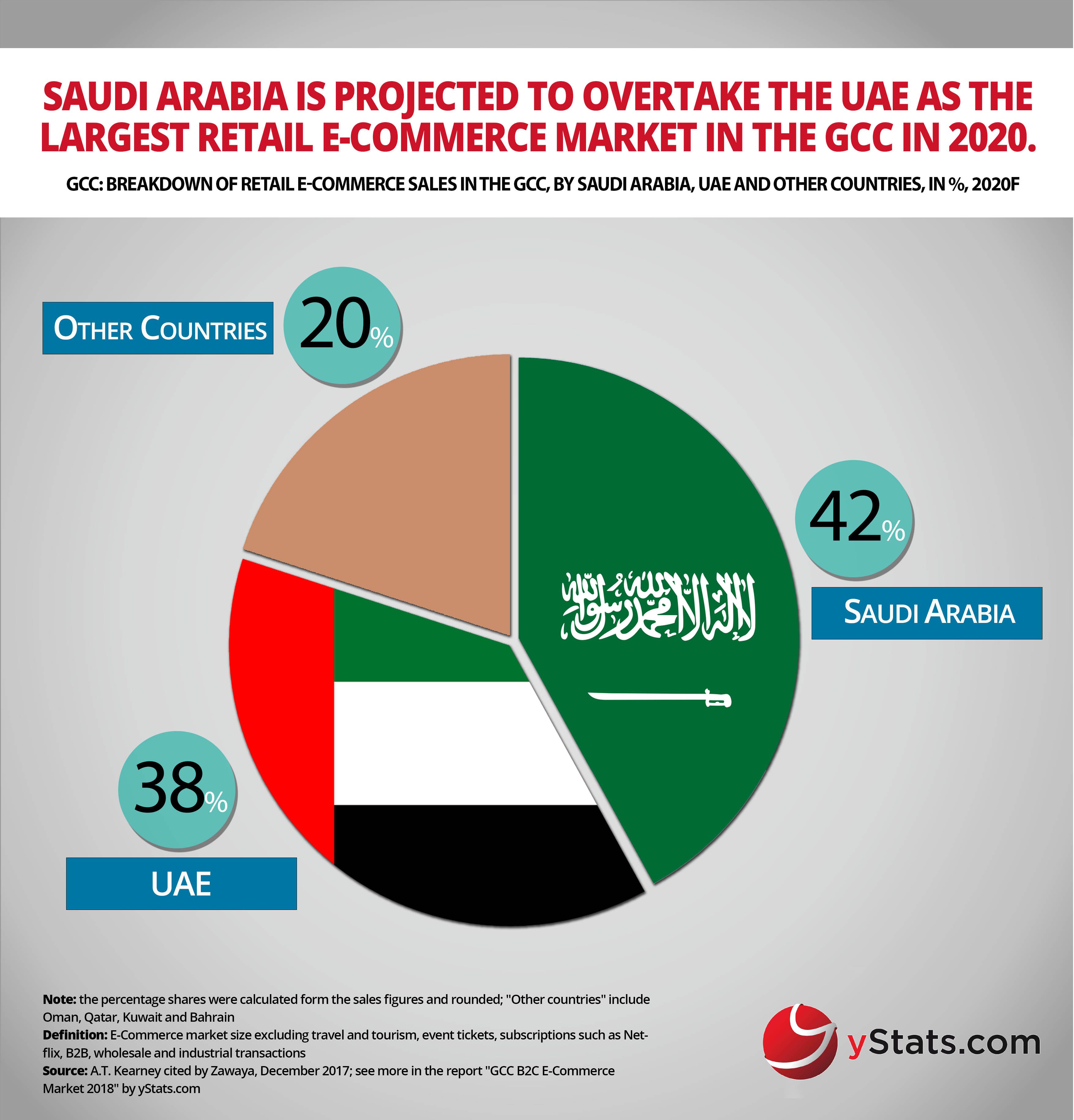

The UAE and Saudi Arabia currently make the largest contributions to the region’s rising B2C E-Commerce sales. While the UAE was ahead of the Kingdom in terms of online retail revenues as of 2017, higher growth rates are projected to propel Saudi Arabia to the leading position in the GCC B2C E-Commerce by 2020, with the UAE moving to the second place. Qatar and Kuwait are projected to rank next, followed by Bahrain and Oman.

Market data and surveys cited in the yStats.com report indicate that interest in online shopping is high among connected consumers in the GCC, but many of them hesitate to buy over the Internet due to lack of trust in E-Commerce and digital payment methods. For example, in Bahrain, searching for information about products and services is among the top online activities, but online shopper penetration reaches less than one-third of Internet users. Also in countries with higher online shopper penetration rates, such as the UAE and Saudi Arabia, the frequency of buying online remains low, with the majority of shoppers making purchases at online stores less than once a month.

A survey of GCC millennials conducted in 2017 revealed that not being comfortable with online payments was the main barrier to buying online. Cash on delivery is the preferred method of payment in the GCC, outranking credit cards by a high margin. Furthermore, the local E-Commerce offering remains limited, especially in smaller markets, while international E-Commerce platforms such as Amazon.com, eBay.com and AliExpress.com rank among the most visited websites in these countries. Amazon boosted its presence in the region with the purchase of Souq.com in 2017, a major regional online marketplace based in the UAE. The competition is expected to intensify as local rivals attract investments and international players take notice of the fast developing B2C E-Commerce market.