yStats.com, Germany-based secondary market research firm specialized in E-Commerce and Online Payments business intelligence, has released a new publication, entitled “Global Payment Innovation Trends 2019”. The report reveals how new technologies, such as AI, biometrics, cryptocurrency, IoT and voice payments, are transforming the payments landscape worldwide.

Mobile biometrics as the future of payment authentication

One of the top innovation trends in global payments is mobile biometrics. As of 2019, consumers own billions of electronic devices equipped with some form of biometric authentication – fingerprint, iris scanner, facial recognition, and others. Coupled with the digital payment means, for example Apple Pay, Google Pay and Samsung Pay and the like, these devices enable a new form of payments – biometric payments. According to a projection cited in the yStats.com report, the value of mobile payment transactions authenticated with biometrics is projected to shoot up between now and 2023, with more than two-thirds of global shoppers willing to use biometrics to secure their payment transactions.

AI and IoT at the forefront of payment innovation

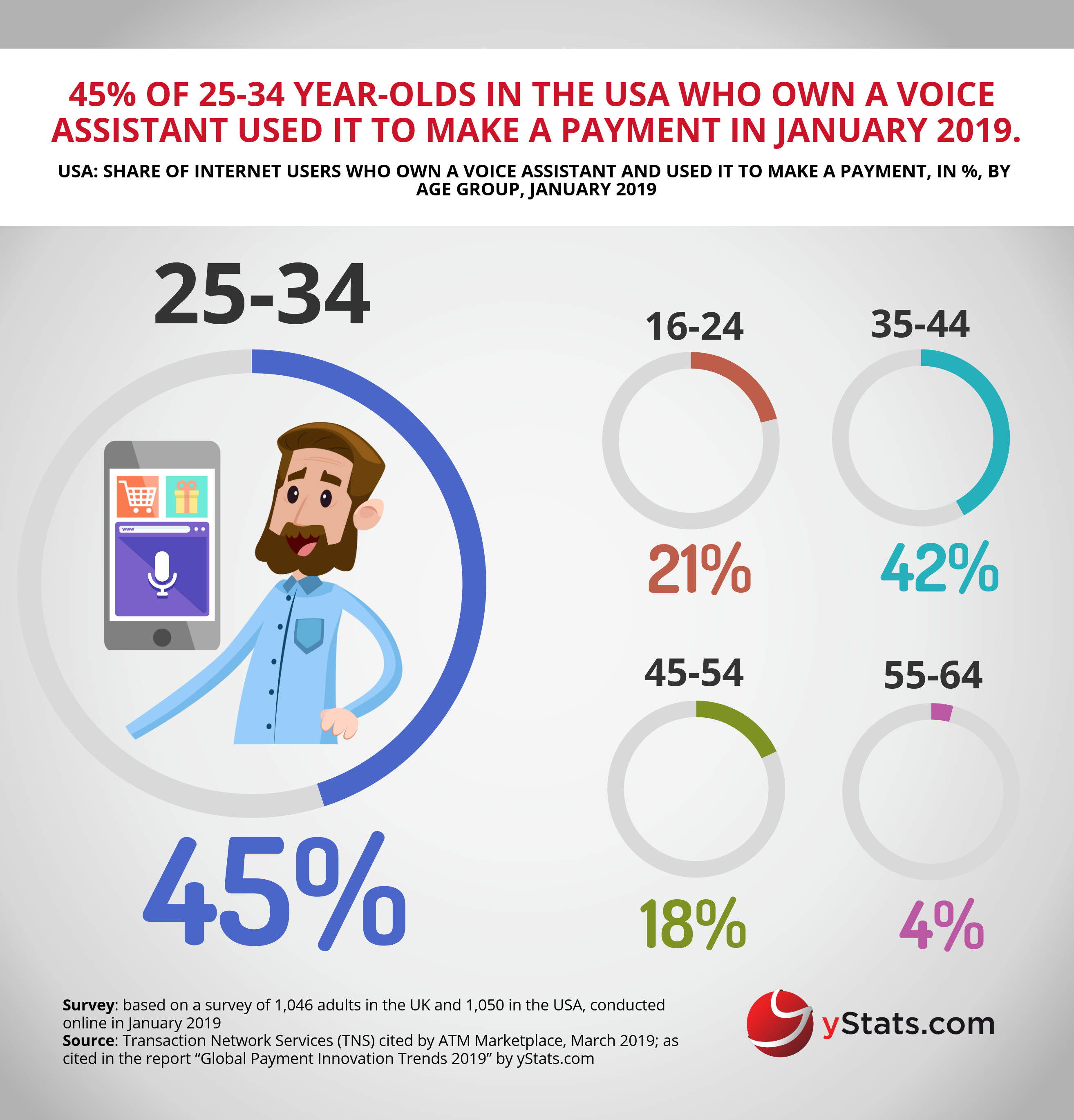

Artificial Intelligence (AI) and the Internet of Things (IoT) have also found their application in global payments. AI-powered virtual assistants are increasingly used to make digital purchases and payments using voice command. In advanced digital markets such as the USA and the UK, a double-digit share of consumers who own a voice assistant have already used it to make a payment, according to a recent survey from 2019 cited by yStats.com. IoT payments are also projected to see rapid growth through 2023, led by connected cars and connected home devices. However, for these new payment forms to realize their full potential, many consumers still need to be convinced that such transactions are secure. More than one in two global respondents would only use voice-activated payments for lower value purchases, and less than 50% trusted that such voice payments are secure.

Cryptocurrency payments are yet to gain consumer trust

Among other innovations, the cryptocurrency boom has spilled over into the payments space, as the yStats.com report shows. While only a single percentage point of global economic activity with Bitcoin is attributed to merchant payments as of the beginning of 2019, this still translates into a payment volume of several billions of U.S. dollars over the full year. Although more businesses are starting to accept crypto payments and new digital currencies are being launched, consumers are wary of the high volatility and complexity of this payment mean.