E-Commerce and Online Payments research specialist yStats.com, based in Germany, has published a profile of Apple’s fast growing digital wallet solution. “Apple Pay Profile 2017” reveals key facts about this wallet, describes its major features, and cites latest statistics concerning Apple Pay’s adoption and usage rates.

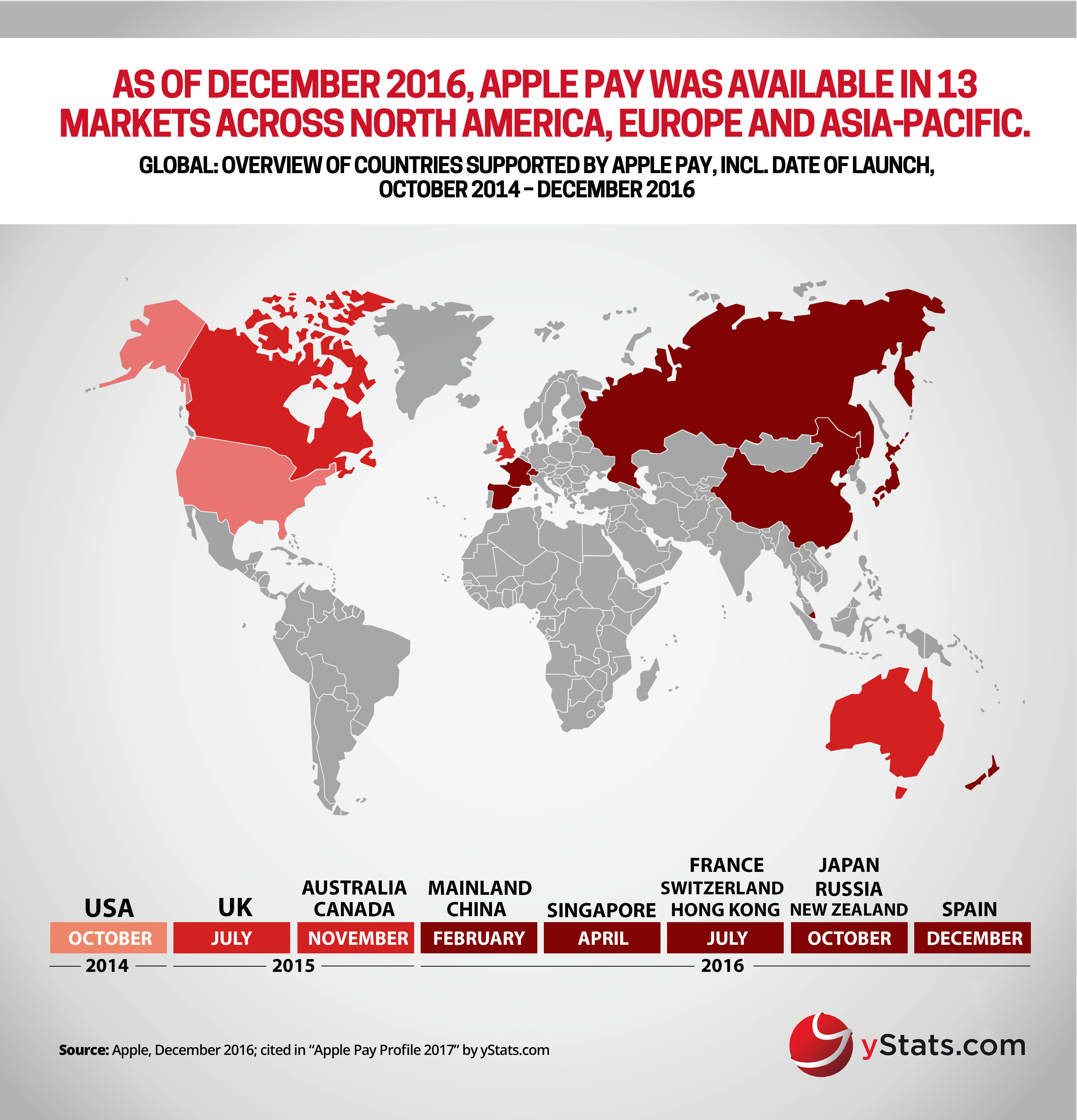

Apple’s digital wallet solution, Apple Pay, has been in the spotlight since its initial launch in the USA in October 2014. The digital wallet profile from yStats.com dives into a comprehensive description of the solution, including its main features, coverage, adoption and usage data. The publication details the evolution of Apple Pay from a pure smartphone wallet to a robust digital payment method for in-store, online and mobile purchases. The geographical expansion of Apple Pay is also shown, covering the month-by-month growth from one to thirteen markets by the end of 2016.

Among the specifics revealed about Apple Pay is its reliance on encryption and user authentication via Touch ID or pass code for secure payment transactions. Furthermore, Apple Pay’s profile from yStats.com cites varying numbers of participating banks, financial institutions and payment processors in different countries. Finally, examples of merchant adoption of the Apple Pay service are provided, including companies from retail, E-Commerce, travel, energy and restaurant segments. Latest figures from the USA, Apple Pay’s largest market so far, show that more than one-third of retailers adopted Apple Pay in their stores. Usage rates among consumers are yet to catch up, as although the majority of iPhone users are aware of Apple Pay, less than a third have made a purchase with it.