yStats.com has released a new report titled “Global Mobile Payment Methods: Second Half 2016”. In this publication, the Germany-based secondary market research specialist summarizes the latest mobile payment market statistics and trends from 20+ countries worldwide. Among the report’s key findings is the projection of strong growth for mobile payment volume resulting in its increased share of consumer payments by 2021.

Mobile payments currently account for a one-digit share of total consumer card payments, but are predicted to more than double their share by 2021. This is one of the forecasts cited in yStats.com’s report. Another revelation is that remote mobile payments in the form of M-Commerce and app commerce contribute most of the mobile payment volume in regions such as Europe and North America, leaving proximity mobile payments only a small share of the total. Nevertheless, in-store contactless payments with mobile phones and wearables are projected to show strong double-digit growth within the next few years.

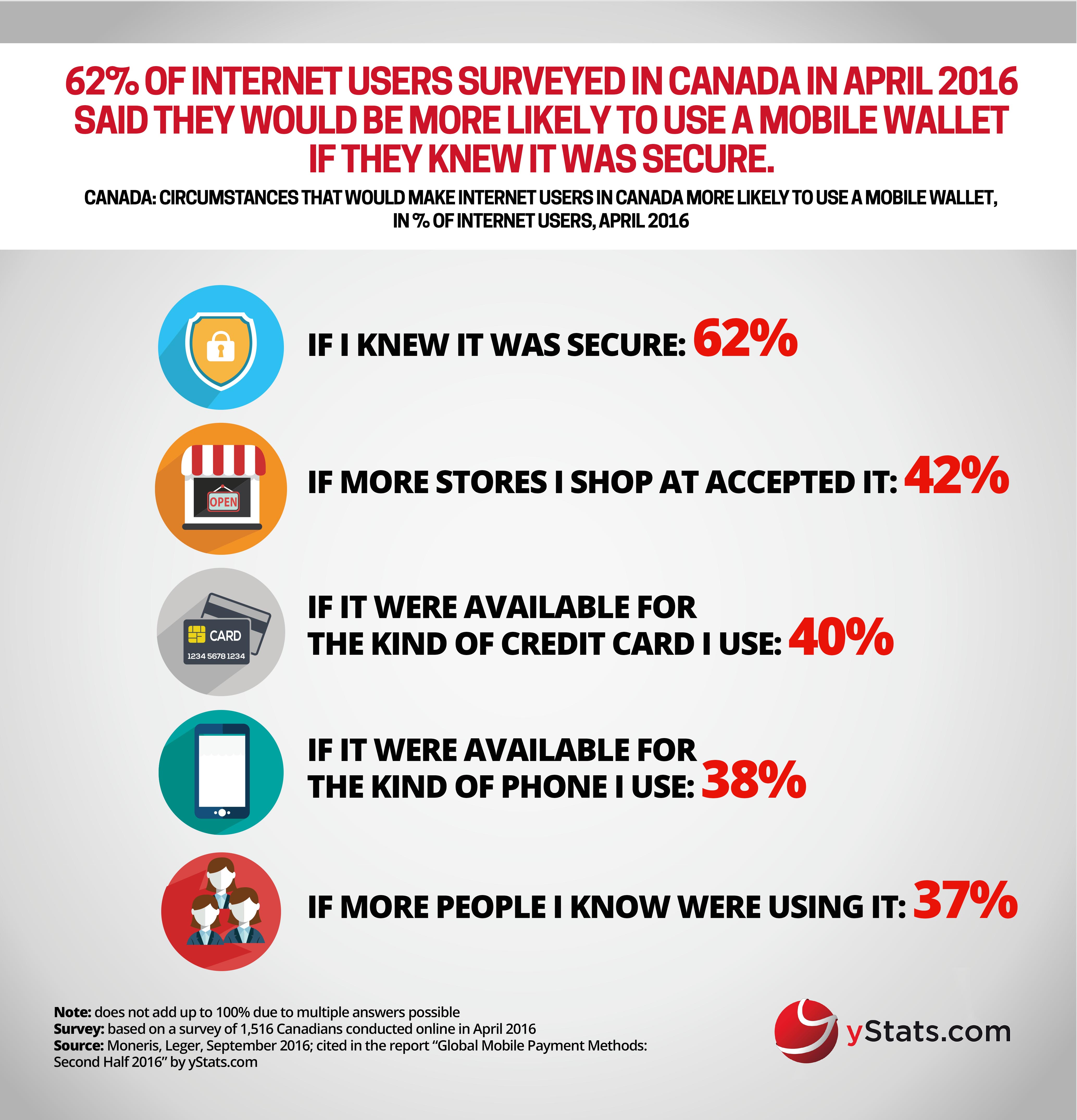

One of the key factors that could contribute to a greater usage of mobile payments is diminishing consumers’ security concerns. Even in countries with high levels of mobile technology adoption, such as South Korea, fear of information leakage and safety concern is the top reason for not using mobile financial services, according to a survey cited in yStats.com’s research. Another example is Canada, where close to two-thirds of Internet users said they would be more likely to use mobile wallets if they knew the payment mode was secure.

The consumer sentiment towards mobile wallets and other mobile payment methods varies worldwide. While over 50% of banked consumers in Latin America showed interest in mobile payments, shoppers across multiple European countries demonstrated high awareness of innovative payment options, but not many of them utilize this technology. In a cross-country comparison presented in yStats.com’s report, several emerging markets ranked above advanced economies both in current and potential usage of mobile wallets by smartphone owners.