“Latin America Online Payment Methods: Full Year 2015” is the title of a new report published by Hamburg-based secondary market research company yStats.com. According to the report’s findings, credit card is the leading payment method used by online shoppers across the region, though card usage meets fierce competition from alternative payment methods in selected countries. Furthermore, the report reveals that mobile payments are gaining acceptance in Latin America, driven by mobile device usage and M-Commerce growth.

With B2C E-Commerce growing rapidly, the online payment landscape in Latin America remains dynamic. Credit card was the leading payment method used by online shoppers in countries such as Brazil, Colombia, Mexico and Dominican Republic in 2014/2015, according to research cited in the report by yStats.com. However, credit cards meet intense competition from alternative payment methods, including cash on delivery, PayPal and local banking schemes.

For example, in Brazil, over half of online shoppers paid by credit card, as of 2015, and around one third used local banking method Boleto Bancario, as yStats.com’s report reveals. In Mexico, debit cards and PayPal were used by about 50% of online shoppers, only slightly behind credit card use. In Colombia, nearly a quarter of online shoppers chose cash on delivery to pay for their purchases made over the Internet.

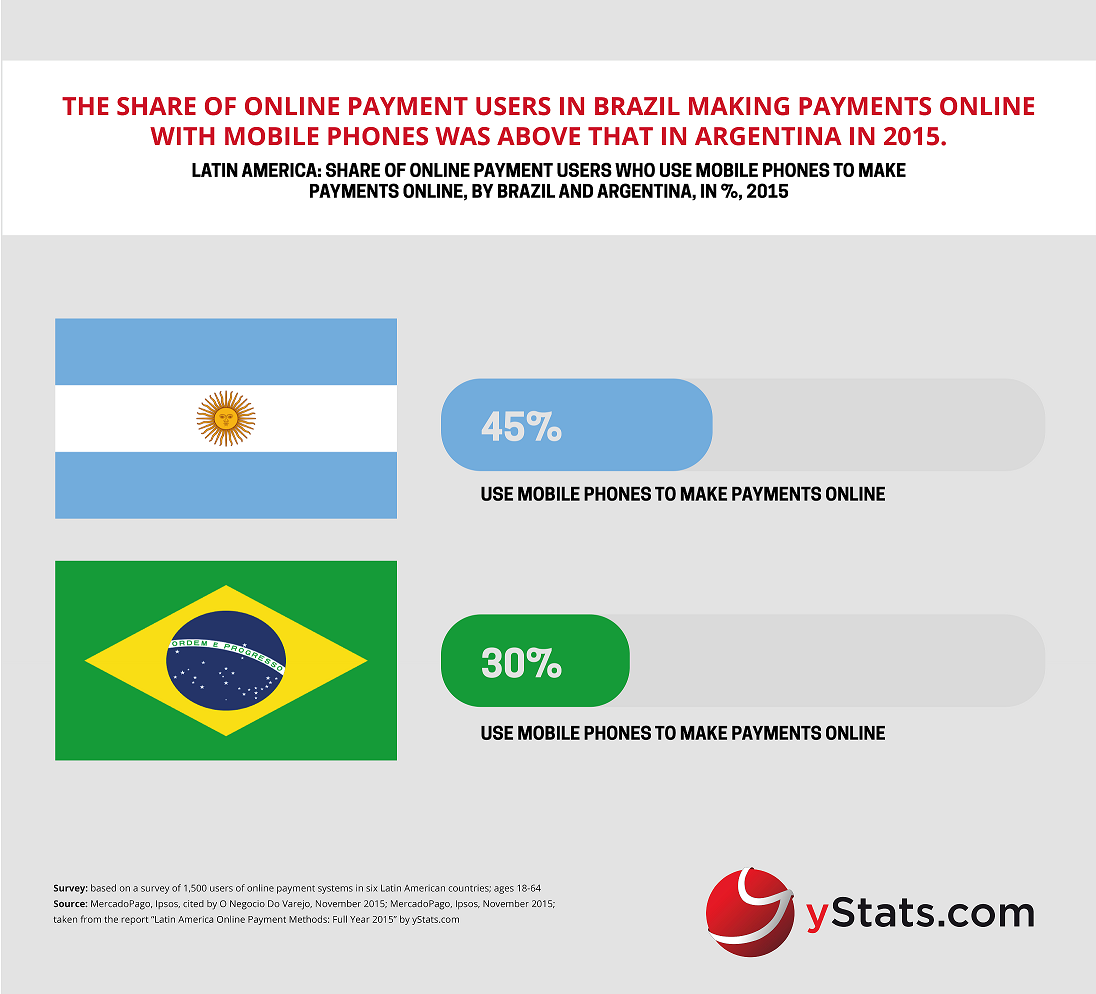

Another important trend in digital payments in Latin America is the growing use of mobile payment methods, spurred by the rise of mobile shopping and smartphone penetration. In Argentina, the share of online payment users who made payments via mobile phones doubled in 2015, while in Brazil it was already close to one half. Furthermore, in Mexico, over 50% of consumers with bank accounts reported that they would probably or definitely use mobile payments in the future, according to a 2015 survey cited in yStats.com’s report.