“Global Mobile Payment Methods: Full Year 2016” is the title of the new publication released by Germany-based secondary market research specialist yStats.com. According to this report, remote mobile payments still outweigh in-store payment via mobile devices, through the latter also shows promising growth. Convenience was revealed as the main driver of consumer adoption of mobile payments, and concern about security as its main deterrent.

Mobile payments remain on the growth path worldwide, according to this report from yStats.com. Their share of consumer card payments is projected to more than double between 2016 and 2021. Most of the mobile payment volume is still contributed by remote commerce transactions via E-Commerce websites and applications, with in-store purchases via mobile accounting for only a small one-digit percentage share of total in regions such as Europe and North America. A recent survey cited in yStats.com’s publication also indicates that mobile payment usage is more common in E-Commerce than in physical stores.

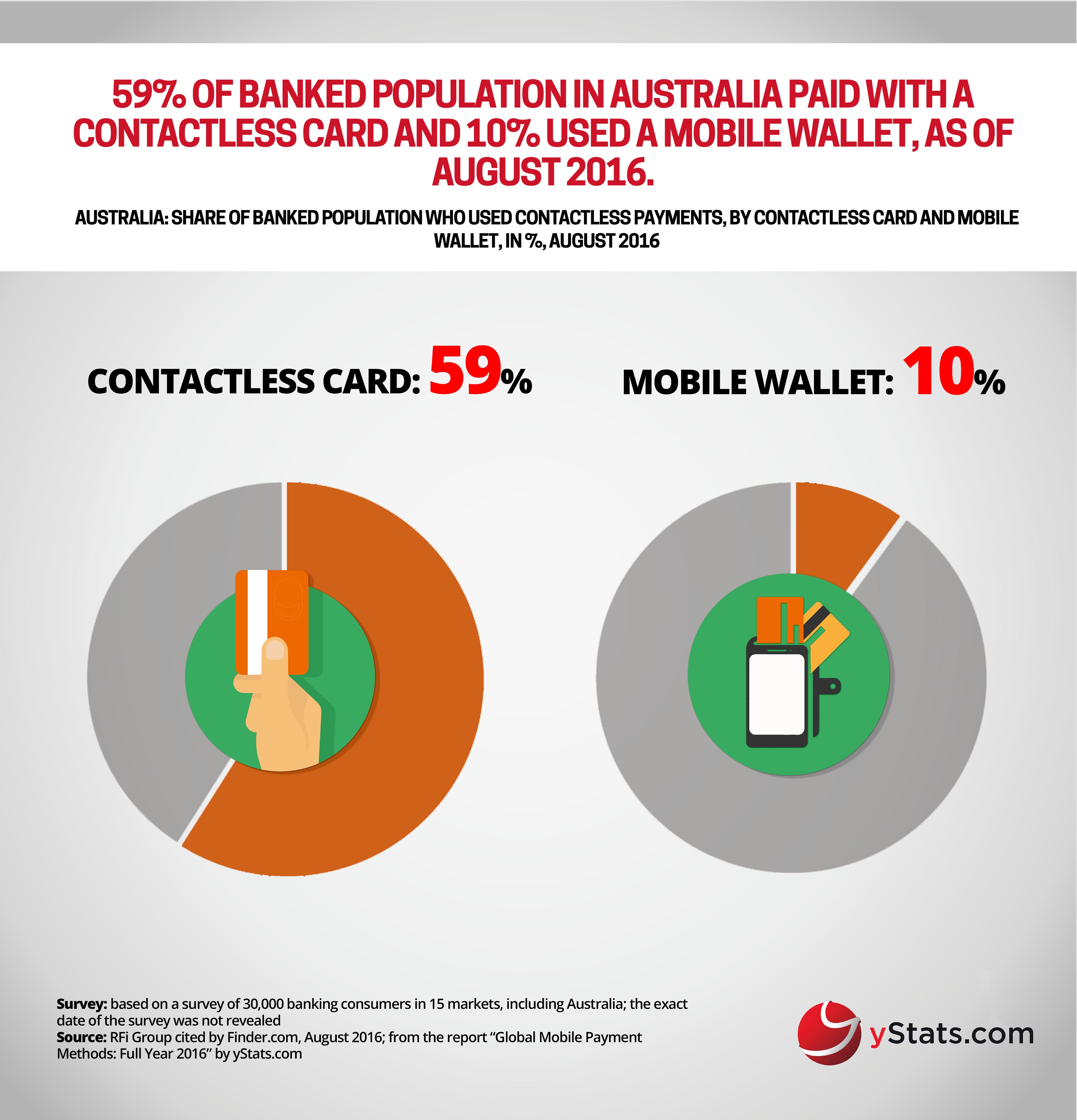

Nevertheless, in-store global mobile payment transaction value is rising at double-digit rates on the global scale. Contactless payment user penetration has reached more than one-third of the banked population in selected countries across Asia-Pacific, North America and Western Europe. Furthermore, mobile wallets achieved double-digit usage rates among mobile shoppers in several countries, including China, the UK and Australia, and are on the rise in other markets as well, according to information cited in this report by yStats.com.

Multiple consumer surveys included in yStats.com’s report point to convenience as the main driver of mobile payment adoption. In South Korea, for instance, mobile payment users prefer this method above all for its convenience and fast processing speed. On the other hand, concern over security of payment information and personal data is the major deterrent preventing consumers from using mobile payments more. In Canada, for example, more than 50% of surveyed Internet users said they would be willing to use mobile wallets if they knew it was secure.