Germany-based E-Commerce and Online Payment market intelligence company yStats.com released a new report titled “UAE B2C E-Commerce Market 2016”. In this publication, the secondary market research specialist reveals the main characteristics of the online retail market in the UAE, important market trends and rankings of the E-Commerce competitors. The report concludes that in spite of the country’s population reaching just over 9 million people, online retail market in the UAE is the largest across the Middle East.

B2C E-Commerce is a fast growing segment of the retail market in the United Arab Emirates (UAE), a new report by yStats.com reveals. Driven by high Internet penetration, growing smartphone ownership and increasing consumer demand, online retailing in the UAE is predicted to grow at double-digit rates over the next five years. In spite of the country’s 9-million population being only ninth largest in the Middle East and North Africa, B2C E-Commerce sales in the UAE are the highest in the region and are predicted to remain as such for the near future.

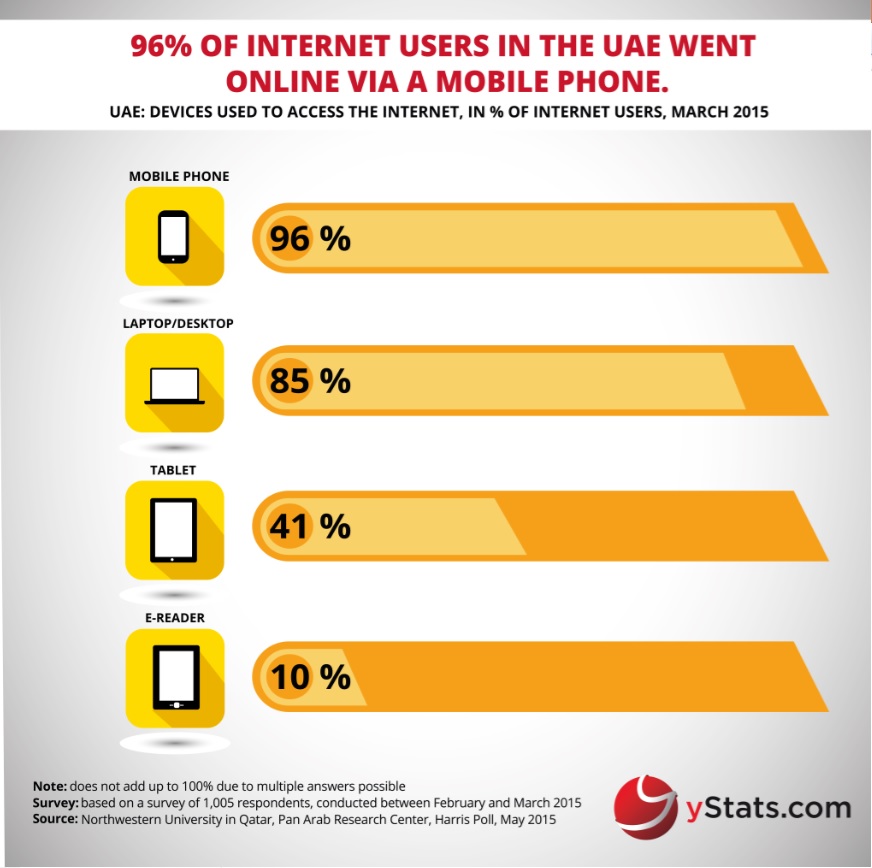

The UAE had one of the highest Internet, mobile phone and smartphone penetration rates across the Middle East and Africa in 2015. The spread of Internet-enabled mobile devices especially contributes to the growth of the mobile shopping market in the UAE, as yStats.com’s report shows. As of early 2015, mobile phone was used by a larger share of Internet users than any other device to connect to the web. As a result, M-Commerce’s share of online retail in the UAE more than doubled in two years to 2015. Another significant trend is the development of cross-border E-Commerce. The UAE had one of the highest shares worldwide of online shoppers who make purchases exclusively from websites outside their country.

Nevertheless, the online shopping market in the UAE is led by a local company. Based in the UAE, Souq.com operates across a number of countries and holds a high double-digit share in its domestic market. In early 2016, Souq.com raised USD 275 million of investment, to be used for growing its marketplace further. Other local players, such as JadoPado and Awok.com which started as online pure-play retailers are also switching to the marketplace model, as revealed in yStats.com’s report. Overall, the Internet retailing market in the UAE is dominated by a handful of large players, but their combined share has been shrinking as competition in the growing market intensifies.