According to the findings of a new publication by Germany-based secondary market research company yStats.com, “WeChat Pay Profile 2019”, WeChat ranks second by share of the mobile payments market in China. In addition to summarizing the latest stats and figures about the wallet, the publication also describes the services’ main features and outlines WeChat Pay’s international expansion strategy.

WeChat Pay expands its international presence through partnerships

WeChat Pay is a digital wallet function integrated into a popular mobile messaging platform WeChat, or Weixin, in China. Besides China, the service is also available to users in a few other countries and is accepted by merchants in nearly 50 countries. WeChat is constantly expanding its international coverage through local partnerships, targeting Chinese tourists travelling overseas. For example, in late 2018, it cooperated with a similar service LINE Pay in Japan to enable the Chinese to pay by scanning QR codes with WeChat Pay while visiting this country, as quoted in the yStats.com report.

WeChat Pay is used for a variety of day-to-day payments

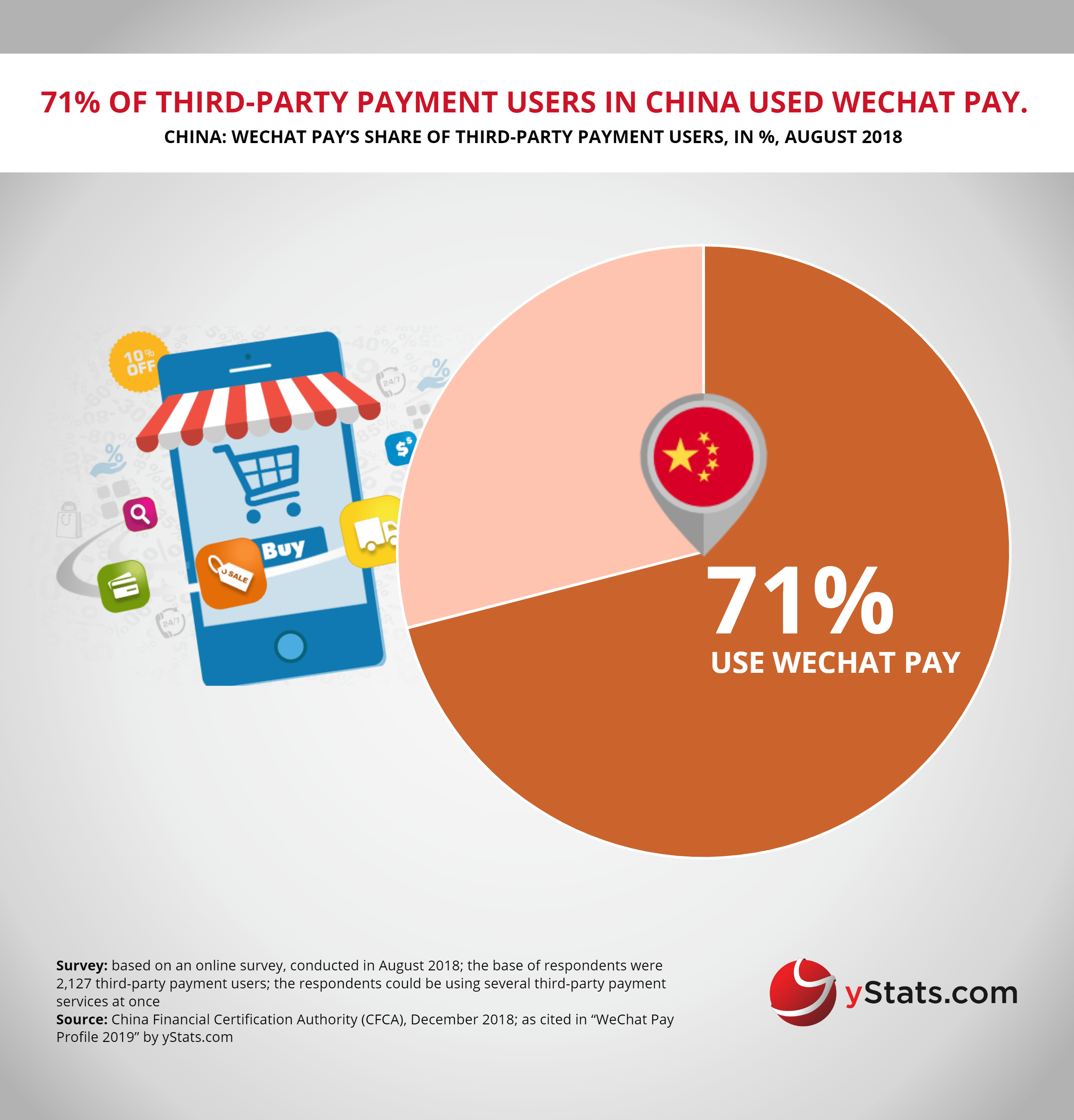

In its domestic market, WeChat Pay faces strong competition from the market leader, Alipay. According to the figures cited in the yStats.com report, Tencent, the company behind WeChat Pay, had a double-digit share of the third-party mobile payment market in China in 2018, but was more than 10 percentage points behind Alipay. In addition to mobile payments for in-store and digital purchases, WeChat Pay is also used to make peer-to-peer transfers, pay utility bills, buy tickets or invest in financial products. Furthermore, WeChat’s digital bank solution is accessed by nearly one in four users on a daily basis.