yStats.com, a leading secondary market research company based in Hamburg, Germany, has updated its regular series of reports about worldwide online and mobile payment markets with the publication of “Asia-Pacific Online Payment Methods: Full Year 2017”. The report unveils the payment method preferences of online shoppers in the top 10 markets of the region and summarizes the key developments in mobile payment.

Digital and mobile wallets have emerged as a leading payment method in Asia-Pacific’s fast growing E-Commerce market. In 2017, they accounted for close to one-half of online retail sales in the region, outpacing payment card. The high share of this method is driven by the dominance of Alipay and WeChat Pay in China, as well as the growth of mobile wallets like Mobikwik and Paytm in India. In advanced economies, such as Japan, South Korea and Australia, credit cards still top the preference ranking of online shoppers, according to information in the yStats.com report, although digital wallet payments are also on the rise in these countries.

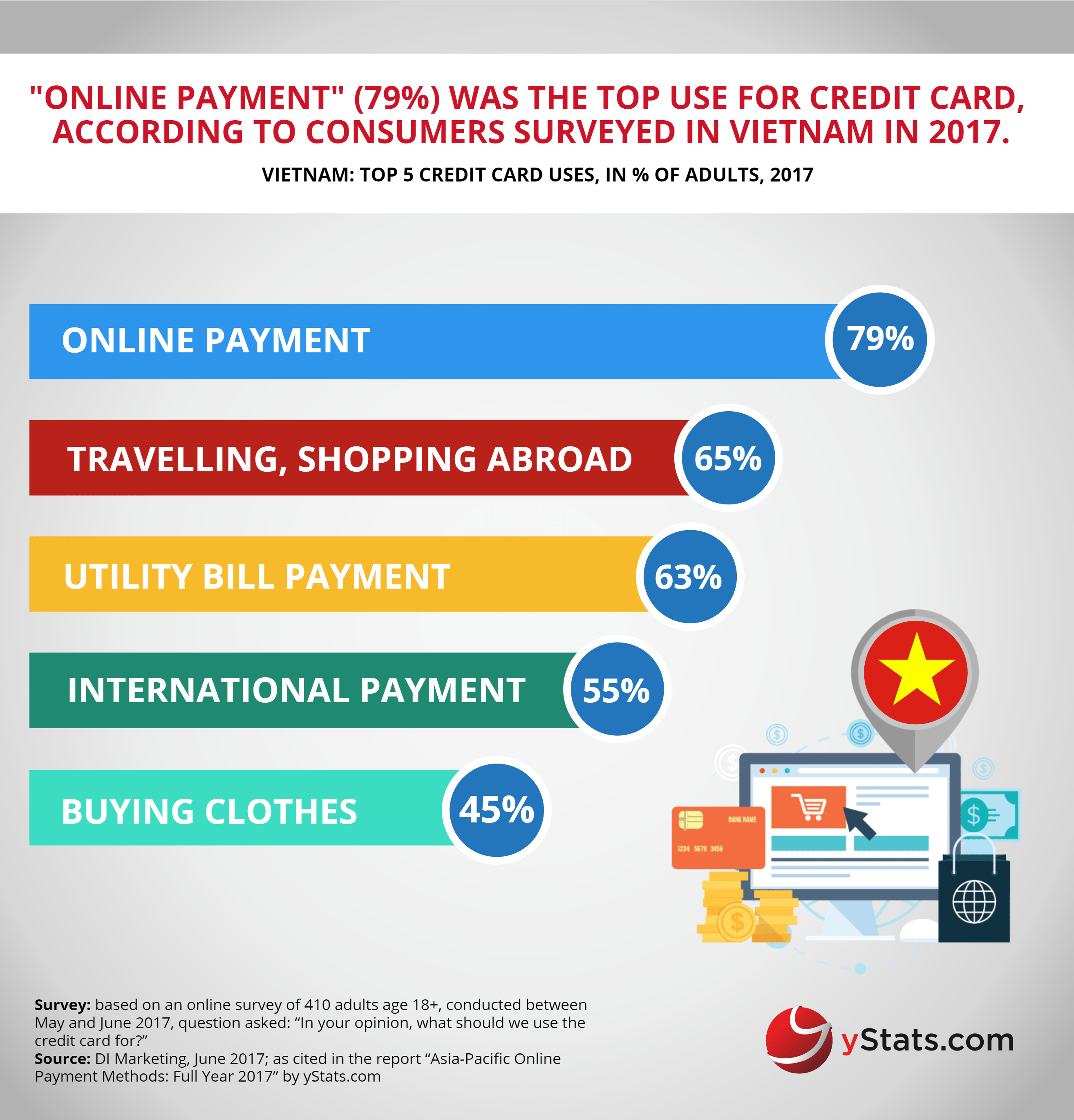

Besides E-Wallets, other major alternative payment methods include cash on delivery and bank transfers, both popular among digital consumers in Southeast Asian nations. At the same time, online shopping is driving the use of credit cards in countries such as Indonesia and Vietnam, where consumers see digital purchases as one of the main uses of plastic, as surveys cited in the yStats.com report reveal.

Mobile payments show rapid growth across Asia-Pacific, already the top region worldwide by mobile payment user penetration. The mobile trend is led by China, where QR-based payments are second only to cash when it comes to paying in-store. In Japan also an increasing number consumers show interest in QR code payments. The example of consumers in South Korea shows that mobile wallets are gaining popularity due to the fast payment process and simplicity, although security remains a major concern.