A new market report by a leading Hamburg-based secondary research organization yStats.com, titled “Global Alternative Online Payment Methods: Full Year 2017” summarizes the latest market trends and contains rankings of the top payment methods used by online shoppers worldwide. According to the report’s findings, alternative payment methods like E-Wallets are projected to overtake credit cards in global B2C E-Commerce.

Online payment method rankings for nearly 40 countries worldwide, cited in the yStats.com report, point to the increased usage of alternative methods, especially digital wallets. While credit cards topped the global ranking of consumer preferences in 2017, by 2021, digital wallets and other alternative means are projected to account for a much higher share of worldwide online sales than cards. The two main reasons for the alternative payments’ rise revealed in the yStats.com report include their popularity in emerging markets and the growing concern of consumers in advanced economies over the safety of card information online.

The leading alternative online payment method, E-Wallet such as Alipay and PayPal, accounts for the dominant share of E-Commerce sales in the world’s largest region in online retail– Asia-Pacific. Despite being the most popular payment mean in countries such as Japan, South Korea and Australia, credit cards fail to grasp a higher share of the region’s E-Commerce turnover due to the growing contribution to alternative payment methods’ share from emerging markets, most of all from China. Also in Europe, digital wallets lead the preference of online shoppers on the regional level, although credit cards account for most of online transactions in countries such as France and Sweden. Other popular alternative methods include cash on delivery, payment by invoice and via bank transfer.

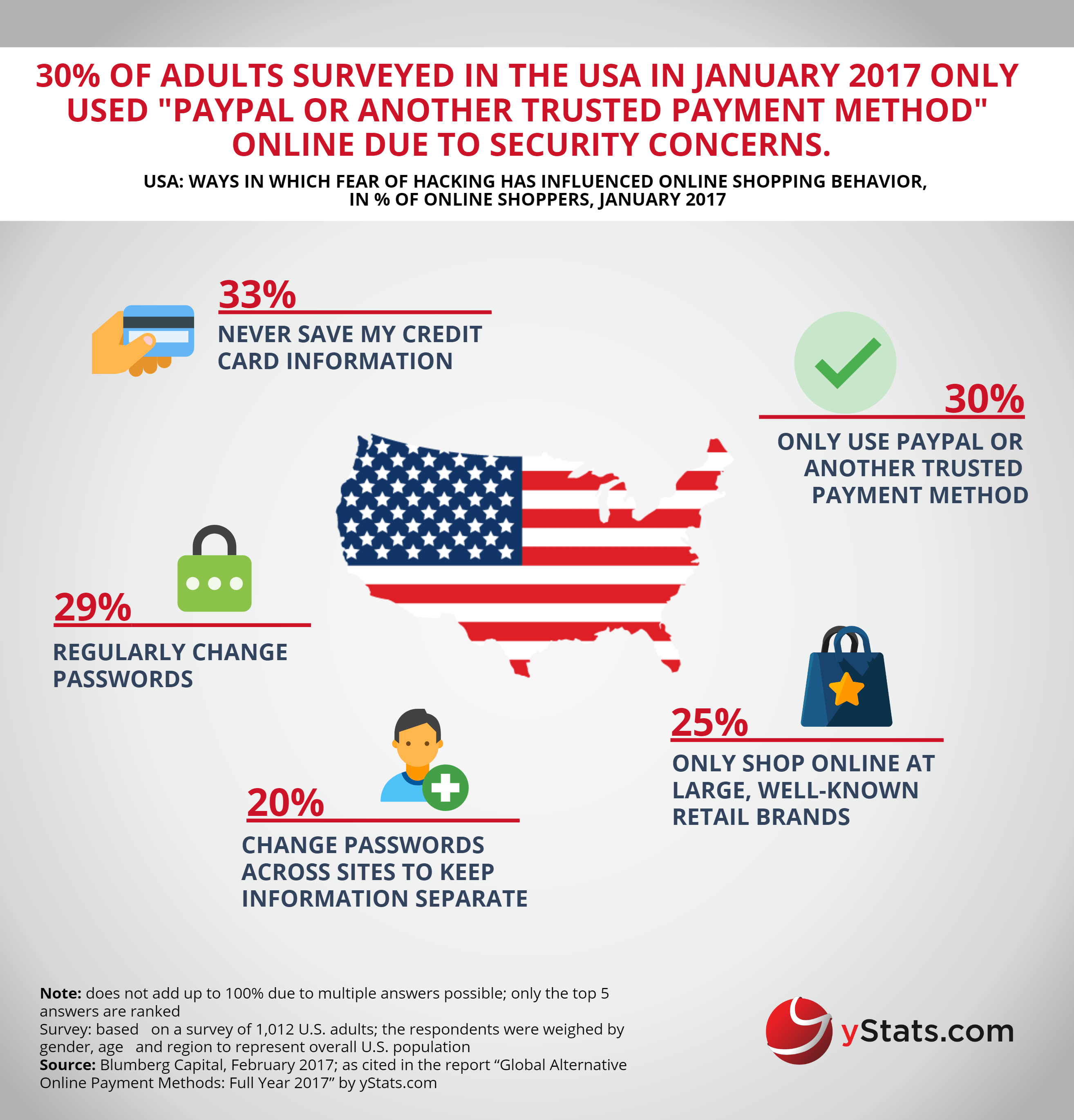

In markets where credit cards traditionally hold the leading position, such as the USA, the use of alternative means of payment is on the rise. One of the factors behind this trend is consumers’ growing concern over the online security of credit card information. A recent survey from the USA, cited in the yStats.com report, revealed that due to the fear of hacking, one-third of respondents never saved their credit card details on E-Commerce websites and a similar number only used PayPal or alternative trusted payment methods.