According to a new report by Germany-based secondary market research firm yStats.com, payment security and data privacy continue to be the major factors influencing the adoption of mobile payment methods worldwide. The publication, titled “Global Mobile Payment Methods: Full Year 2015”, also reveals that emerging markets are often ahead of advanced economies in mobile payment use.

The global development of both remote and proximity mobile payment depends to a large extent on the users’ perception of security of such payment methods. In 2014, more than 50% of global consumers were worried about their personal data’s safety when using mobile payment apps. Also in 2015, data privacy and security were the top two considerations of consumers in the adoption of innovative payment methods, such as mobile payments, as cited in the new report by yStats.com.

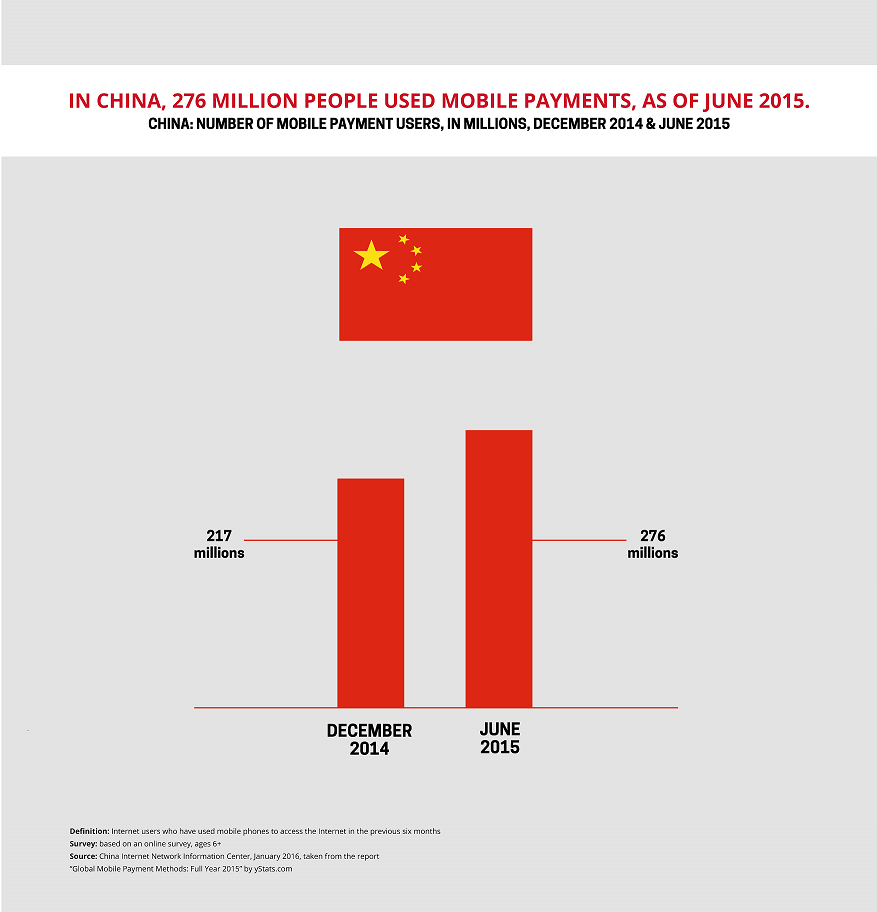

Another finding contained in yStats.com’s report is that emerging markets often outpace advanced economies in the adoption of mobile payments. For example, in the emerging markets of Asia-Pacific, the penetration of smartphone wallets was nearly double this number for the developed markets of the region. In China, mobile payment users accounted for nearly half of all mobile Internet users, as of mid-2015. While Chinese users are motivated by convenience of various mobile payment methods, in some African countries mobile payments are an important alternative to banking services. Kenya is the region’s leader in mobile payments, but also in other countries, such as Nigeria, it is a fast growing trend. Meanwhile, in another emerging region, Latin America, mobile payments are driven by the growth of mobile shopping.

Various types of mobile payments are also gaining ground in Europe, as the report by yStats.com reveals. For example, peer-to-peer payment was the mobile payment type most known to smartphone users in Germany in 2015, while in the UK, contactless mobile payments were booming, with monthly volumes topping the 1 billion pounds mark near the end of the year. Similarly, in North America, awareness of mobile payments is spreading, reaching close to half of smartphone users in Canada. In the USA, multiple providers compete for a larger share of the fast growing mobile payment market, including large tech companies such as Apple, Google, Facebook, Samsung and others.