A new publication from Germany-based leading secondary market research organization yStats.com indicates that online payments around the world are changing. The report, titled “Global Online Payment Methods: Second Half 2016”, synthesizes the most up-to-date information about online shoppers’ preferences for payment methods, while also highlighting general online payment dynamics and mobile payment trends. Among the key revelations of the report is the finding that emerging markets stand at the forefront of the global shift from traditional to alternative online payment methods and from online to mobile payments.

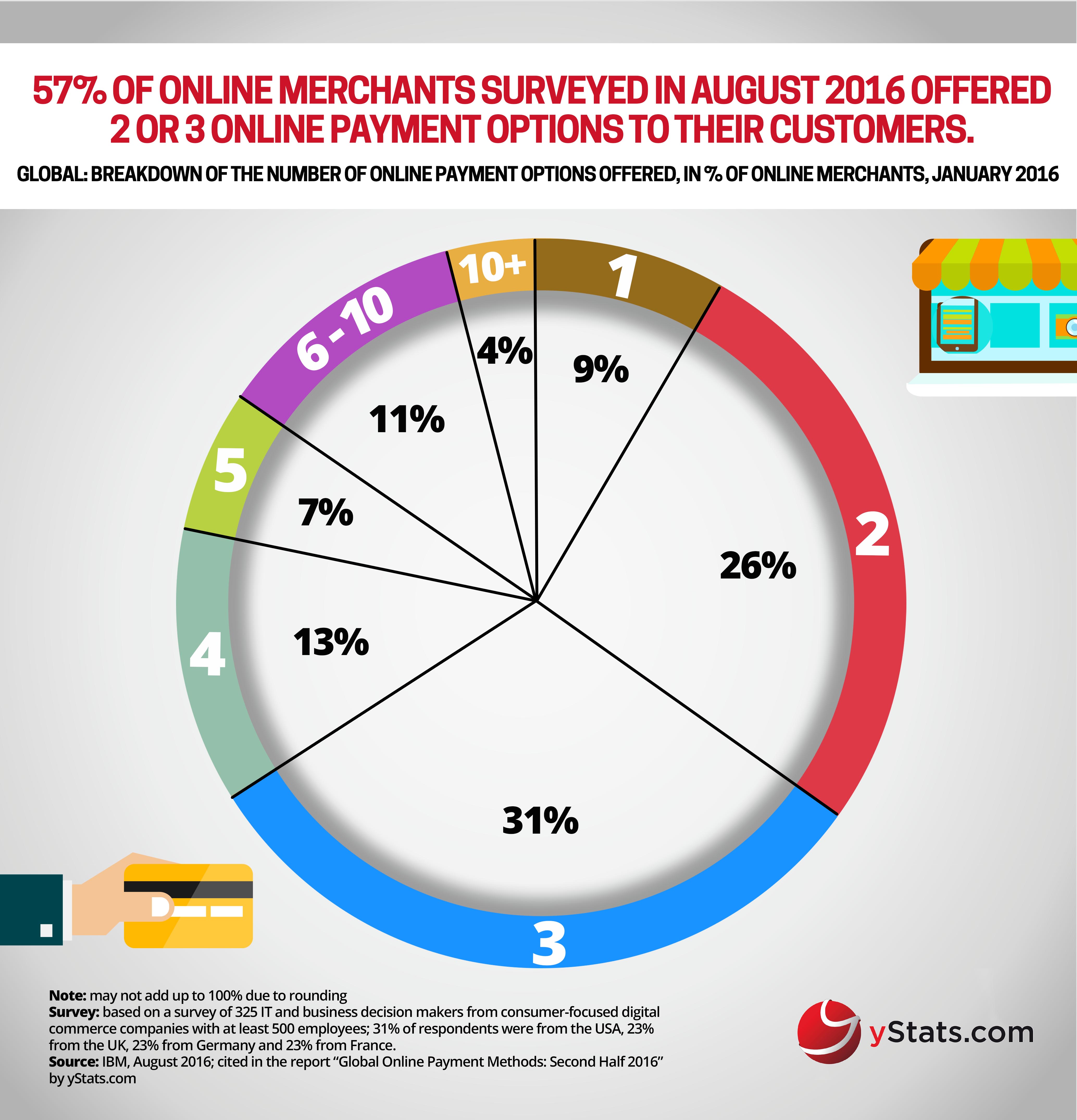

The preferences of online shoppers with regard to payment methods continue to differ worldwide. Having accepted this fact, two thirds of online retailers now offer at least 3 different payment options, according to an international survey from 2016 cited in the yStats.com report. Although credit and debit cards still account for the highest share of global E-Commerce sales compared to other individual payment methods, the combined share of alternative payment methods now outweighs bank card payments and accounts for more than 50% of global online retail payments.

The fast growing emerging markets stand behind this global trend. Lower bank card penetration in these countries compared to advanced markets encourages the search for new alternatives, thus facilitating payment innovation. This is best seen in proliferation of mobile payments: consumers in regions such as Latin America and Asia-Pacific rank above the global average for willingness to use mobile payments, according to recent research cited in the yStats.com publication. Another 2016 survey suggests that smartphone owners in India, South Korea, South Africa and the UAE are more likely to be using mobile wallets than those in the USA, the UK or Germany.

Whether in emerging or advanced markets, payment security is one of online shoppers’ top considerations when paying for purchases. While established online payment security measures like 3D Secure authentication remain valid, new authentication methods are being developed to answer the demand for increased payments safety. As the yStats.com report reveals, fingerprint ID is one of the top innovative measures that online shoppers are willing to use in the near future.