Germany-based secondary market research specialist yStats.com has released a new publication titled “Asia-Pacific Online Payment Methods: Second Half 2016”. The report includes information about the payment methods used by online shoppers in this region’s major markets, captures important trends and provides valuable insights into consumers’ preferences related to the use of digital payments. Among the key findings of the report is the continuing rise of mobile payment methods in Asia-Pacific.

Asia-Pacific is the largest global region by B2C E-Commerce sales, featuring various fast growing and advanced online retail markets. Although the rankings of top online payment methods vary by country, the yStats.com report reveals a clear overarching trend: the growing use of mobile payments. Shoppers in Asia-Pacific are more likely to use innovative payment methods such as mobile wallets than consumers in other regions worldwide, with around one-half of Internet users looking forward to being able to make more payments with their mobile devices, according to a survey cited in the yStats.com report.

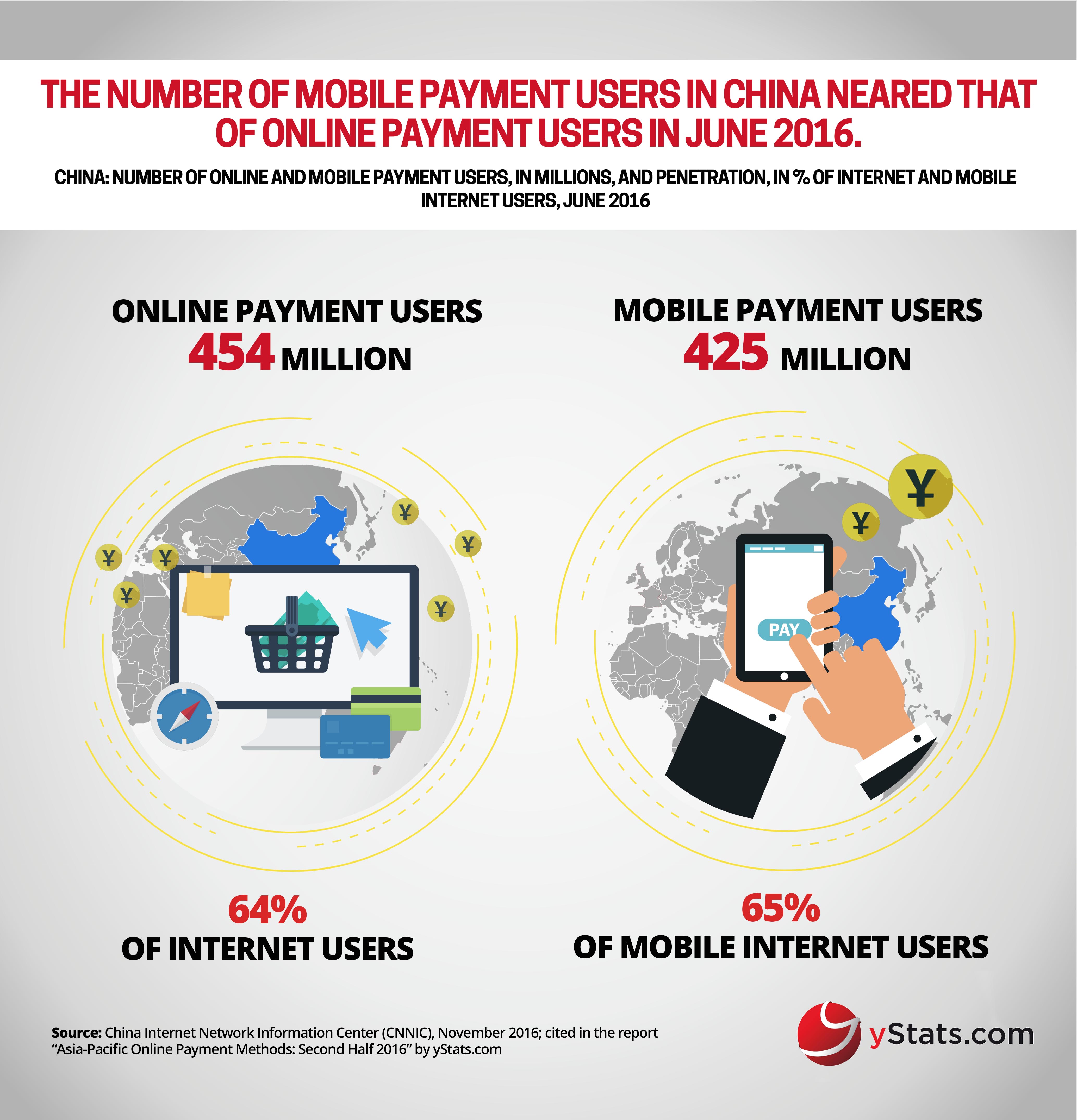

China is one of the leaders of the mobile trend. The number of mobile payment users in this country is catching up with the number of online payment users, while the volume of mobile payments made through third-party services like Alipay and Tenpay already outpaced desktop-based Internet payments in 2016. The figures cited in the yStats.com publication for other markets also indicate the increasing adoption of mobile payment methods. For instance, in South Korea the daily average value of payments made with mobile cards grew by a strong double-digit figure, and in India mobile wallets are projected to increase their share of E-Commerce payments by several percentage points by 2020.

Furthermore, the yStats.com report sheds light on payment-related preferences of online shoppers in Asia-Pacific by citing multiple consumer surveys. While many digital buyers in countries such as Japan and Australia are happy to pay for their online purchases by bank card, in Southeast Asian markets such as Indonesia, Thailand and Malaysia, ATM or online bank transfer are more appealing payment methods. In addition, both convenience and safety are valued by consumers when making payments online or via mobile devices.