The rise of alternative payments is dramatically influencing the global E-Commerce industry. By 2020, the overall share of alternative payment methods in global E-Commerce is forecasted to increase by small double digits, leaving the total E-Commerce share of bank cards in a decline of about the same rate. In lieu of these demands, E-Wallets have risen as a leading payment method particularly when it comes to cross-border shopping, coming in second after credit cards. Interestingly, surveys suggest customers still prefer to have a variety of available payment methods. Furthermore, there are also new developments to M-Commerce as mobile payments become increasingly popular.

When viewed individually, E-Wallet usage around the globe is outpacing credit and debit card payments, with the projection that they will maintain about a third of the global E-Commerce market share. Notably however, credit cards are the top utilized online payment method in percent of global online consumers, with digital payment systems like PayPal and Alipay coming only in second. This discrepancy could be partly due to China, the world’s largest E-Commerce market and major supporter of alternative payment methods, in that E-Wallets made up over half of their online retail sales in 2015. Due to favorability towards E-Wallets from Chinese cross-border shoppers, E-Wallet providers such as Alipay are expanding into foreign markets.

Throughout these changes to the global online payment method landscape, retailers have still found it necessary to offer a variety of payment methods for E-Commerce customers with various preferences. In Europe, online payment methods are especially diverse in that online shoppers in the UK, France, Belgium, and the Nordics favor bank cards, but in Germany, Spain, Italy and the Netherlands, E-Commerce consumers prefer alternative payment methods. Additionally, in regions such as North America and Latin America, online consumers prefer online payment via bank card, but regions such as the Middle East and Africa still favor cash on delivery. Overall, about two thirds of online retailers offered a minimum of 3 different types of payment options to satisfy customer demands from various regions.

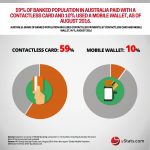

M-Commerce payments have also seen an increase in usage across the globe, with the share of total consumer card payments via mobile device projected to double between 2016 and 2021. As a result, mobile wallet providers are receiving heavy investments for expansions and to create new technologies to improve usability and safety. China is also the world’s leader in the mobile payment market.

For more detailed information, please see our full report “Global Alternative Online Payment Methods: Full Year 2016”.