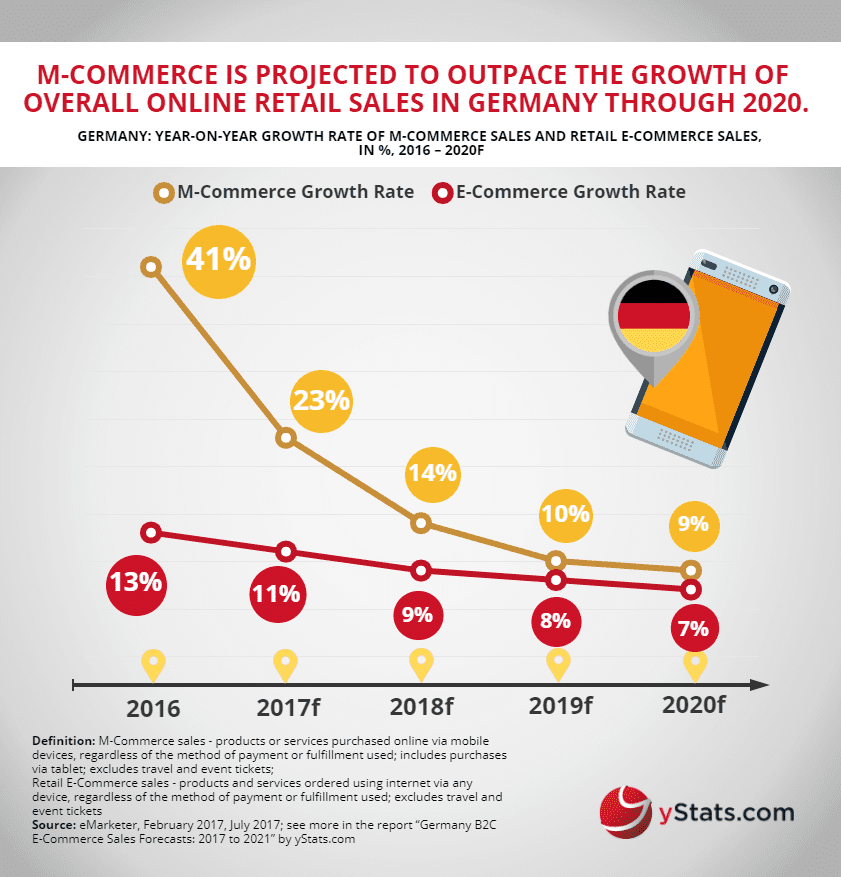

yStats.com, a leading secondary market research company from Hamburg specializing in E-Commerce and online payment market intelligence, has published a new report called “Germany B2C E-Commerce Sales Forecasts: 2017 to 2021”. The report synthesizes predictions about the online retail market for the next several years and comes to a conclusion that the growth of B2C E-Commerce sales is projected to slow, while mobile shopping is still expected to expand at double-digit rates.

The B2C E-Commerce market in Germany is expected to have a lower compound annual growth rate in the next five years compared to last year. This is the result of the increasing maturity of the market. Three-quarters of Internet users in Germany made purchases in 2016, showing essentially no change in penetration from 2015. In 2017, B2C E-Commerce could account for close to 10% of overall retail sales in Germany, according to several sources cited in the yStats.com report. Nevertheless, online shopping is projected to remain on an expansion course, rising by at least a one-digit percentage share every year between now and 2021.

Among the main growth drivers is mobile commerce. Mobile retail sales are projected to maintain double-digit growth rates at least through 2019, to reach a significant share of overall online retail. Furthermore, consumers in Germany are developing omnichannel behaviors which are also projected to influence future E-Commerce sales growth. As of 2017, almost one in seven purchases made online are preceded by research in brick-and-mortar stores, a practice called “showrooming”, according to a survey cited in the yStats.com report.

Multi-channel merchants are among the main beneficiaries of the continuing online shopping boom in Germany due to their ability to offer customers flexible cross-channel options. At the same time, online marketplaces still account for the largest share of E-Commerce sales in Germany. Amazon remains the unchallenged market leader, generating three times more online sales than the nearest competitor, even when excluding marketplace revenues.