A new report, “Middle East and Africa Online Payment Methods 2019”, released by Germany-based secondary market research specialist, yStats.com, sheds light on the latest developments in the region’s digital payment landscape. According to this research, cash on delivery remains a popular option for online shoppers in MENA, but use of electronic means, such as cards and digital wallets, is growing. In Sub-Saharan Africa, mobile payments are on the rise thanks to the adoption of mobile money services.

Digital buyers in the UAE and Saudi Arabia pay in cash

Cash on delivery has been a top payment method used by online shoppers in countries such as the UAE and Saudi Arabia. However, recent surveys cited in the yStats.com report show that consumers are now becoming more comfortable with paying online. In the UAE, more than two-thirds of shoppers who paid online at least once by a card or a digital wallet will consistently choose this method in the future.

Payment preferences of online shoppers in Africa vary

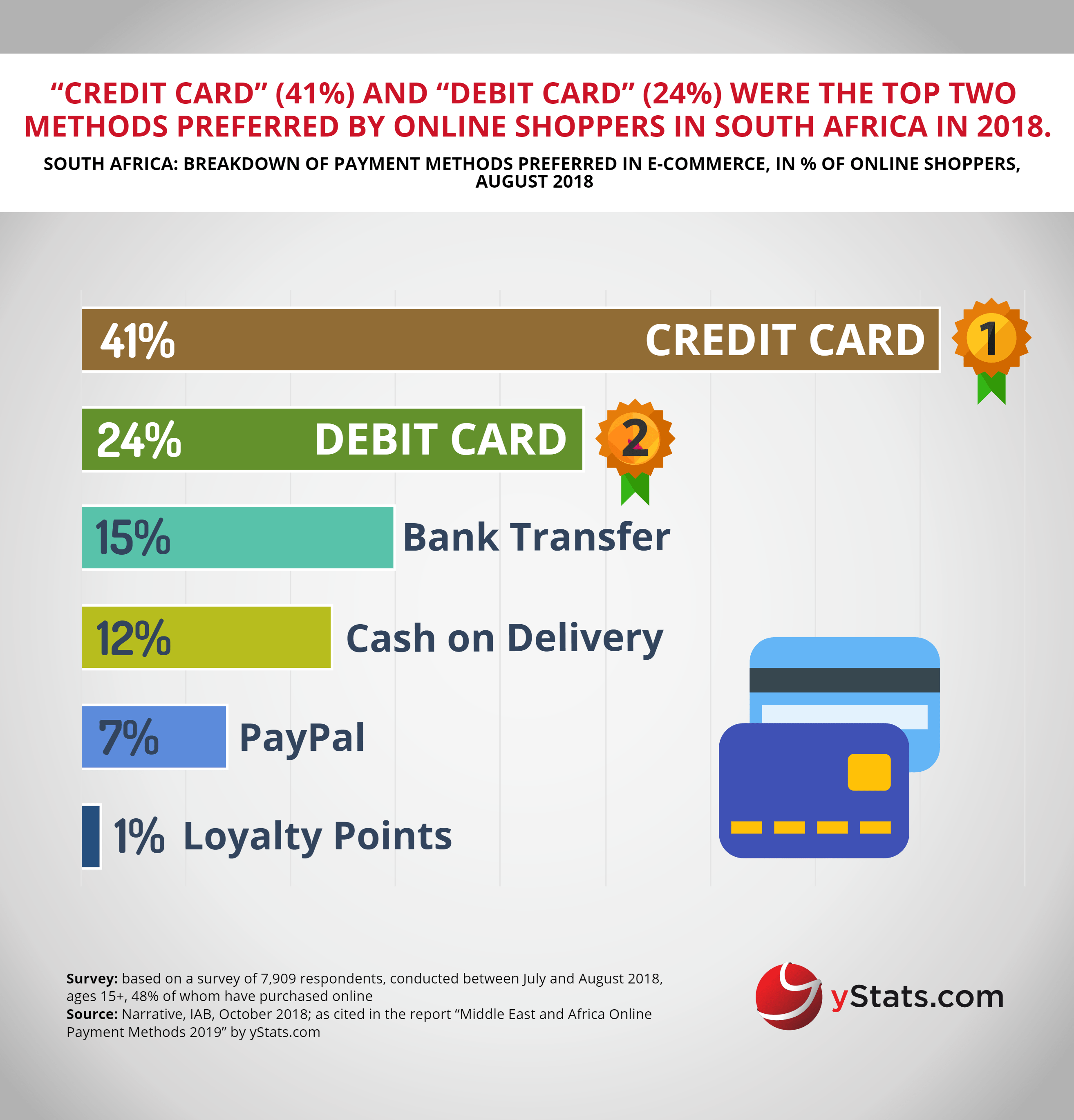

The African continent shows diverse preferences of digital buyers when it comes to payment means. South Africa stands out with the majority of shoppers paying online by credit or debit card. In Egypt, digital wallets such as PayPal and CashU are popular; while in Uganda, more than one in two online shoppers choose to pay via mobile money services, according to data cited in the yStats.com report.

Mobile payments on the growth path in the Middle East and Africa

Mobile payment adoption is gradually taking off, driven by mobile wallets in the MENA region and mobile money in Sub-Saharan African countries, as shown in the yStats.com report. A number of mobile wallet solutions were rolled out over the past months, including Google Pay in the UAE and Apple Pay in Saudi Arabia. At the same time, mobile money services such as M-Pesa are helping drive financial inclusion in African countries, where card and bank account penetration rates are generally low double or even single digits.