“The Impact of PSD2 on European B2C E-Commerce & Online Payment 2019” is the topic of a new market report released by Hamburg-based desk research specialist yStats.com. The report demystifies the implications of PSD2, SCA and XS2A for the online retail payments market in Europe by synthesizing the latest trends, projections, consumer and retailer surveys.

PSD2’s main provisions for E-Commerce payments

The second Payment Services Directive (PSD2) modernizes the payments market regulations in the European Economic Area (EEA), aiming to protect consumers, make online payments more secure and encourage competition and innovation. The key provisions of the directive, including Strong Customer Authentication (SCA) and Access to Account (XS2A) are reshaping the E-Commerce payments landscape in Europe and are expected to have a major impact on the market’s development in both the short and the long term, as the yStats.com report reveals.

The impact of SCA on E-Commerce conversion rates

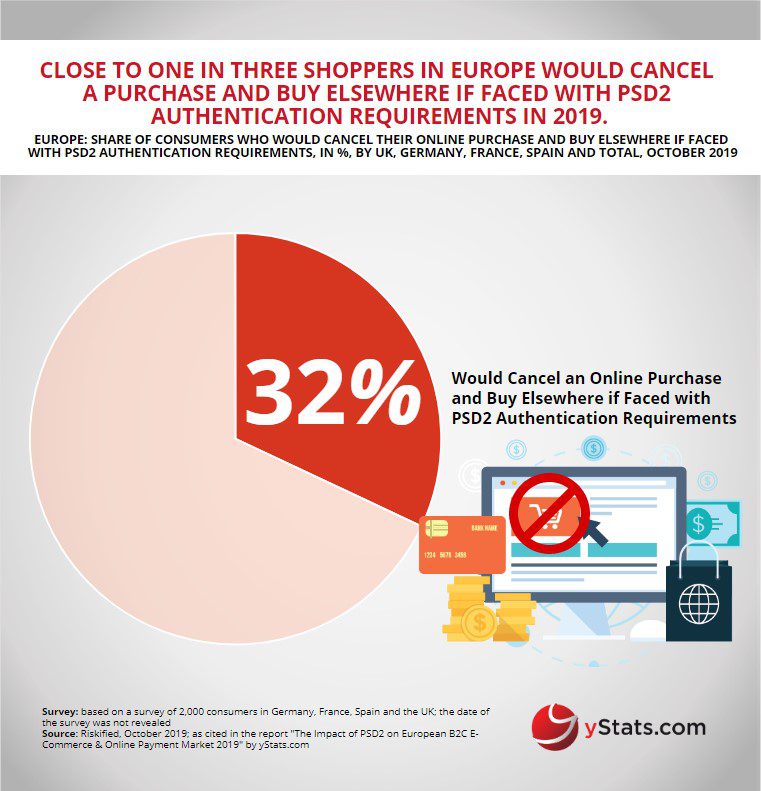

The effects of the SCA requirements that entered into force in September 2019 with a prolonged implementation period until the end of 2020, are expected to be especially felt in the near term. While the main purpose of the new rules is to strengthen the security of online shopping transactions amidst the growing threat of card not present fraud, industry participants have voiced a concern over the potential negative implications of SCA on the conversion rates at online shops. Close to one-third of consumers would abandon an online purchase and complete it elsewhere when faced with a request for a two-factor verification under SCA, according to a recent survey cited by yStats.com. Payment providers also expect a multi-fold increase in both step-up verification requests and transaction rejections as a result of SCA. In order to mitigate these effects, merchants are advised to apply Transaction Risk Analysis (TRA), adopt the new 3D Secure 2 protocol for card payments and offer alternative payment methods to their customers.

Access to accounts to shake up the E-Commerce payments mix

Besides addressing the security of E-Commerce transactions, PSD2 also opened up the European payments market to new players in the face of Third Party Payment Providers (TPPs), requiring account providers such as banks to allow TPPs accessing the accounts on their customers’ behalf, known as Access to Account or XS2A. These provisions are expected to intensify competition, drive innovation and stimulate the emergence of new payment services in the long term. The E-Commerce payments mix in Europe is also expected to change as a result, with the cards’ share declining, and alternative payment methods rising.