yStats.com, Germany-based secondary market research firm specialized in E-Commerce and Online Payments, has published a new report titled “MENA B2C E-Commerce Market 2019”. The report covers 12 leading countries in this region and contains a projection that MENA’s online retail market will more than double in size between 2019 and 2022.

B2C E-Commerce sales growth projections in MENA

B2C E-Commerce in the countries of the Middle East and North Africa (MENA) is nascent: only a small one-digit percentage of overall retail sales are online as of 2019. As the market has not yet lived up to its potential, rapid growth rates are projected for B2C E-Commerce sales in MENA with a forecast that by 2022, the market will be more than twice its 2019 size. Higher Internet and smartphone penetration rates are boosting digital connectivity of MENA’s consumers, while improving logistics and payments infrastructures lay the ground for future growth. At the same time, lack of trust in online shopping remains a major barrier for B2C E-Commerce development and helps cash on delivery maintain the lead over digital payment methods in many countries of the region, as the yStats.com report shows.

MENA’s Top 3 B2C E-Commerce Markets

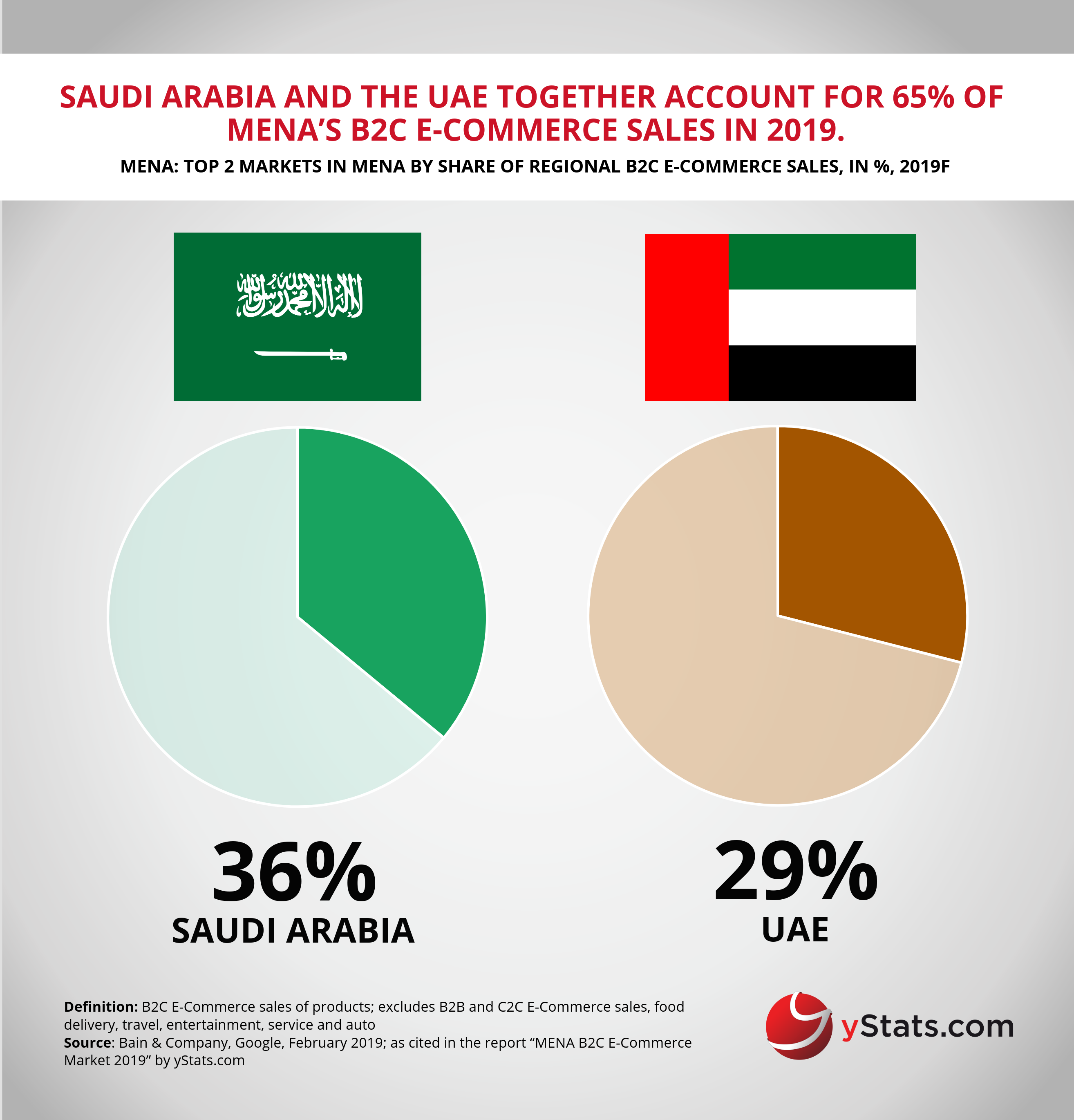

The top two countries in MENA in terms of B2C E-Commerce market size in 2019 are Saudi Arabia and the UAE. Combined, these markets account for nearly two-thirds of the region’s online retail sales. Both Saudi Arabia and the UAE are projected to maintain strong double-digit growth rates through 2022. By the end of this period, the UAE is expected to achieve a double-digit penetration of E-Commerce in retail sales, according to a forecast cited in the yStats.com report. Egypt is a rising star of MENA’s B2C E-Commerce, with growth rates of above +30% between 2019 and 2022.

Leading Online Shopping Trends in MENA

M-Commerce and cross-border online shopping are the leading trends in MENA’s online retail landscape, according to the yStats.com report. More than 50% of digital buyers in the Middle East place orders using their phones, and a double-digit share of online shoppers in Egypt, Saudi Arabia, the UAE, and other countries, purchase from international sellers. The top global platforms used for digital shopping include Amazon and AliExpress. The former is also expanding local presence in the region following the acquisition of a leading local E-Commerce merchant Souq.com.