A newly released report from Germany-based secondary market research specialist yStats.com entitled “Europe Online Payment Methods 2019” covers the latest trends and developments in digital payments across the region. Among the key findings in this report, credit cards and digital wallets continue to dominate the European E-Commerce payments landscape, but mobile payment apps are growing in popularity and usage.

Online payment methods preferred by shoppers in Europe vary

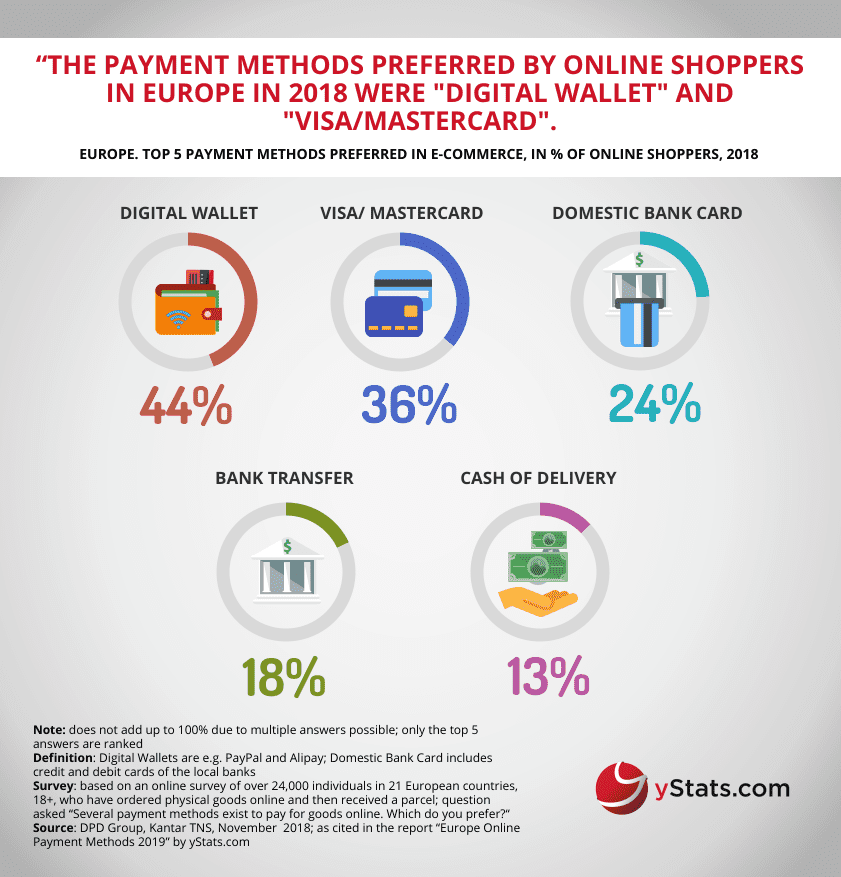

Credit or debit cards and PayPal were the top two payment methods accounting for nearly three-quarters of E-Commerce sales in Europe in 2018, according to recent data cited in the yStats.com report. However, there was also significant variance in online shoppers’ preference for payment methods by country. In the Netherlands, for example, online banking method iDEAL beat both digital wallets and cards in terms of usage in E-Commerce and in Poland, local fast transfer services such as PayU and Prezelewy24 were in the lead.

Mobile payments are on the rise

Although Europe lags behind other global regions, such as Asia-Pacific, in terms of mobile payment adoption, the use of payments on smartphones, tablets and wearables is rising, as the yStats.com report shows. Scandinavian nations and the UK are among the leaders of this trend, especially when it comes to making mobile payments in-store. Also consumers in emerging economies across Europe show interest in mobile wallets. In Russia, the use of Google Pay, Apple Pay and Samsung Pay by connected consumers is already in the double-digits.

Online shoppers value variety and security in payment methods

Overall, surveys cited in the yStats.com report indicate that digital buyers across Europe want online sellers to offer a variety of payment methods at the checkout. More than one in five online shoppers in France are more likely to visit an online store that supports alternative payment methods to credit cards. Additionally, three-quarters of UK buyers prefer E-Commerce websites with a range of payment options. At the same time, shoppers are wary of the safety of their payment details on the Internet. A double-digit share of online buyers in Spain value security over both speed and comfort of the payment process, and more than 50% of shoppers in Sweden try to avoid entering card details on E-Commerce sites.